Elevate Your Hiring with Powerful Demographic Insights

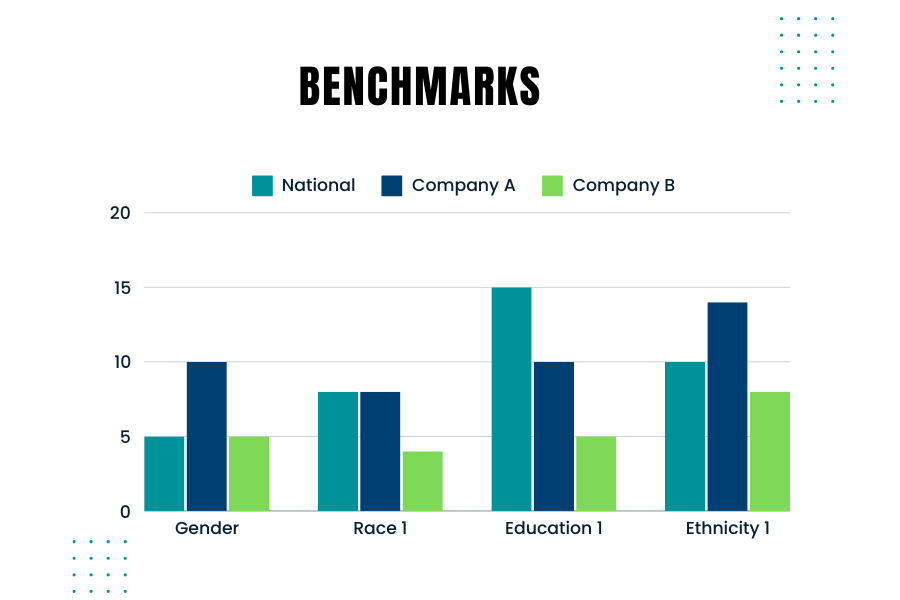

Creating and using benchmarks to compare your company’s hiring demographics against those used by government agencies like the EEOC (Equal Employment Opportunity Commission) is crucial. Benchmarking helps ensure that your company’s hiring practices are fair and compliant with federal regulations. Here’s are some considerations to keep in mind when you consider the right benchmarks

Why Benchmarking Matters

Government agencies monitor and require companies to report on the demographic composition of their workforce, especially larger companies. For instance, the EEOC uses benchmarks to compare a company’s demographics against broader population data from sources like the U.S. Census and the American Community Survey. Knowing how your company’s demographics stack up against these benchmarks is essential for several reasons:

- Compliance: Ensuring your hiring practices comply with laws such as the Civil Rights Act and the Age Discrimination in Employment Act.

- Diversity Goals: Meeting your company’s diversity and inclusion goals.

- Fair Hiring Practices: Ensuring fair and unbiased hiring practices.

Best Practices for Benchmarking

- Collect Internal Data: Gather detailed demographic data of your current workforce and applicants.

- Ensure you track data on race, gender, age, and other relevant demographics.

- Choose the Right External Data: Depending on your hiring scope, use national, regional, or local data. For example, if you recruit nationwide, use national benchmarks. For local hires, consider regional data.

- Occupation and Industry-Specific Data: Align your benchmarks with the specific occupations and industries relevant to your company. Different industries and roles may have distinct demographic compositions.

- Adjust for Educational Requirements: Consider the educational requirements for the roles you are hiring. This will help you compare your applicant pool against the qualified population.

- Use Census Data: The U.S. Census Bureau provides comprehensive data that can be segmented by occupation, geography, and other factors. This data is a good starting point for creating your benchmarks.

Ensuring Fair Selection

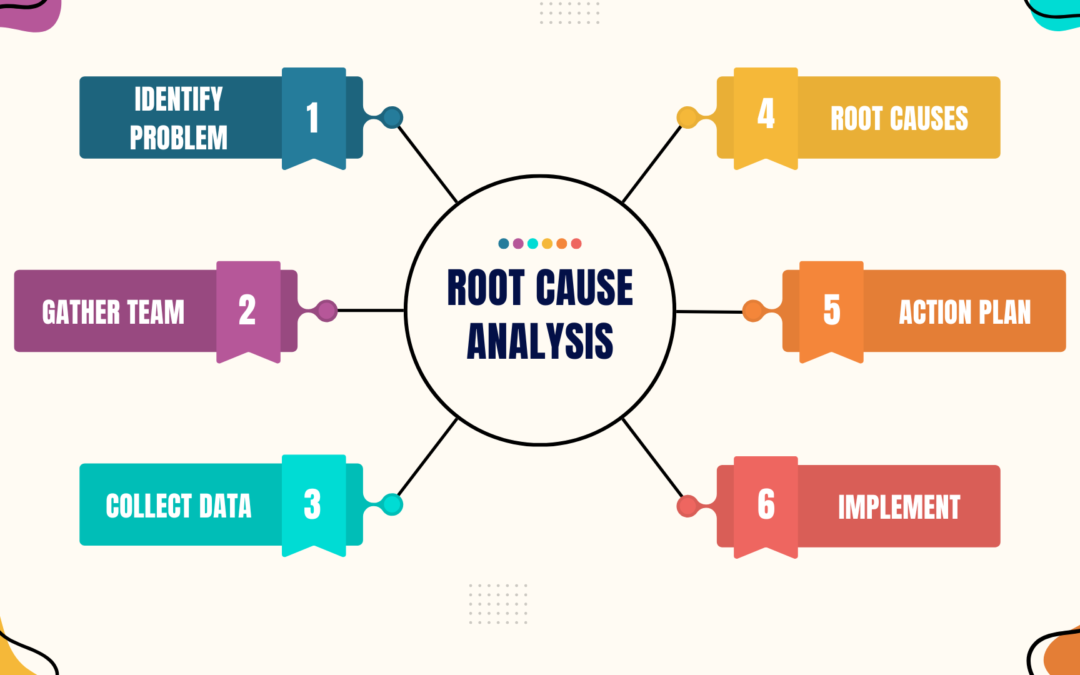

To avoid over- or under-selecting any protected group, follow these steps:

- Regularly Update Benchmarks: Demographic data changes over time. Ensure your benchmarks are based on the most recent data.

- Monitor Hiring Practices: Continuously monitor your hiring practices and outcomes against your benchmarks.

- Training and Awareness: Educate hiring managers on the importance of diversity and compliance with hiring practices.

External Data Sources

Looking at external data sources is important because it provides a broader context for your internal data. It helps you understand the labor market and demographic trends in your industry and location. External benchmarks serve as a snapshot of the current workforce composition, which can change over time.

Creating effective benchmarks involves a blend of using accurate external data and understanding your company’s unique needs. By comparing your company’s demographics against reliable benchmarks, you can ensure fair and compliant hiring practices. Regularly updating these benchmarks and educating your hiring team on best practices will help maintain a diverse and inclusive workforce.

Where Can You Find Additional Information?

- Of Significance: Don’t Miss the Mark! Podcast on what to keep in mind when creating benchmarks

- Harvard Business Review: Smart benchmarking starts with knowing whom to compare yourself to