by editor | Nov 26, 2022 | Compliance and Regulatory - Directors, Documentation - Chaplains, Documentation - Nurses, Hospice 101 - Aides, Hospice 101 - Chaplain, Hospice 101 - Nurses, Hospice 101 - Social Workers, Intake, Medical Records, Metrics and KPIs, Rules and Regulations - Chaplains, Rules and Regulations - Nurses, Rules and Regulations - Office Team, Rules and Regulations - Social Workers

The PEPPER report target areas focus on statistics that will identify potential for improper Medicare billing. Comparison to national, jurisdictional, and state percentiles can highlight a hospice agency’s potential need for change to its practices to guard against improper billing. Hospice agencies can leverage the information on these reports to prioritize internal audit and efforts to ensure accurate billing.

Why did CMS focus on the target areas in the PEPPER report?

- Concern: Are patients eligible and is the agency providing good quality of care?

- Target Areas: Live discharges – no longer terminally ill or patient revocation

- Discussion: A hospice may discharge a patient alive because the patient is no longer eligible, the patient revoked, the patient moved out of the service area, or for cause. The first two reasons are concerning. These reasons for live discharge may indicate that the hospice is admitting patients who are not hospice eligible. If the patient revoked it may indicate that the quality of care is lacking.

- Concern: Is a hospice agency trying to take advantage of the high routine home care rate?

- Target Area: Live discharge with length of stay between 61-179 days

- Discussion: CMS pays a higher rate for the first 60 days of routine home care; the rate of payment is lower for days 61+. High incidence of live discharge in days 61+ may indicate the hospice agency is driven by financial concerns and wants to discharge patients once the rate drops.

- Concern: Is the hospice agency admitting ineligible patients?

- Target Area: Long length of stay

- Discussion: The hospice may be admitting ineligible patients and therefore have an unusually long length of stay as compared to its peers

- Concern: Is the hospice agency targeting patients in more profitable care settings?

- Target Area: Services provided in assisted living facilities

- Discussion: An OIG study published in January 2015 found that Medicare payments for hospice care to patients in assisted living facilities increased significantly. While the diagnoses of patients in this setting typically involved less complex care, these patients remained on hospice longer and hospices received higher payments than for patients in other settings. There is therefore a need to monitor whether hospices are targeting patients in more profitable care settings including assisted living facilities, skilled nursing facilities, and nursing facilities.

- Concern: Is a hospice agency accurately reporting all diagnoses on the claim?

- Target Area: Claims with a single diagnosis code:

- Discussion: A hospice should report on the hospice claim the principle diagnosis and all diagnoses related to the terminal illness and related conditions. A hospice agency that has an unusually high number of claims with a single diagnosis may indicate that the hospice is not reporting all related diagnoses.

- Concern: Is the hospice agency meeting Medicare CoP and able to offer all four levels of care?

- Target Area: No general inpatient or continuous home care

- Discussion: Medicare Conditions of Participation require hospices to demonstrate they can provide all four levels of care: routine home care, general inpatient care, inpatient respite care, and continuous home care to be a Medicare certified hospice provider. A report published by CMS in 2014, included an analysis of 2012 hospice claims:

- 3% of beneficiaries did not have any general inpatient care in 2012

- 1% of hospice agencies did not provide any general inpatient care to any of their patients

- 4% of all hospice days billed in 2012 were billed as continuous home care

- 7% of hospice agencies billed at least one day of continuous home care but the share of continuous home care days billed varied across hospice agencies that billed any continuous home care days

- Almost 90% of hospice agencies that provided continuous home care had less than 1% of their days billed as continuous home care

- Four hospices billed more than 10% of their days as continuous home care.

This target area aims to monitor that hospice agencies are meeting the hospice Conditions of Participation and are able to provide all four levels of care.

- Concern: Is general inpatient care being used appropriately and are patient symptoms being managed well?

- Target Area: Long general inpatient stays

- Discussion: General inpatient stays are intended to be short term, to treat acute symptoms. If a patient has extended general inpatient stay there this level of care is not being used appropriately or that symptoms are not being properly managed.

- Concern: Is Medicare making prescription drug Part D payments when these should be paid by the hospice agency?

- Target Area: Medicare Part D payments for hospice beneficiaries

- Discussion: Hospice agencies are paid a per diem rate for each day that a patient is in hospice care, irrespective of the services that the hospice agency provides to the patient. Drugs that the hospice agency provides to the patient are included in the hospice rate. In 2019, CMS released a report analyzing 2016 Medicare Part D payments being made for beneficiaries on hospice care. Part D is the Medicare prescription drug plan. The study focused on four categories of drugs that are often prescribed to patients at the end of their lives as well as two disease specific drugs for two diseases. Part D should not pay for drugs if the patient is on hospice and the drug is covered under the hospice benefit. Based upon sample results, CMS estimates that Medicare paid $160.8 million for drugs that hospice agencies should have paid for, constituting and overpayment to hospice.

How can a hospice use this information?

With a better understanding of the underlying motivation for each of these target areas, a hospice agency should carefully look at the data on its PEPPER reports to identify any metrics that indicate a need for further investigation and possible process improvements. These reports are a powerful way to benchmark a hospice agency’s performance relative to itself (over a running three year period) as well as relative to other hospice agencies – across the nation, in its state, and in its MAC jurisdiction.

Where can you get more information?

by editor | Nov 13, 2022 | Compliance and Regulatory - Directors, Documentation - Chaplains, Documentation - Nurses, Hospice 101 - Aides, Hospice 101 - Chaplain, Hospice 101 - Nurses, Hospice 101 - Social Workers, Intake, Medical Records, Metrics and KPIs, Rules and Regulations - Chaplains, Rules and Regulations - Nurses, Rules and Regulations - Office Team, Rules and Regulations - Social Workers

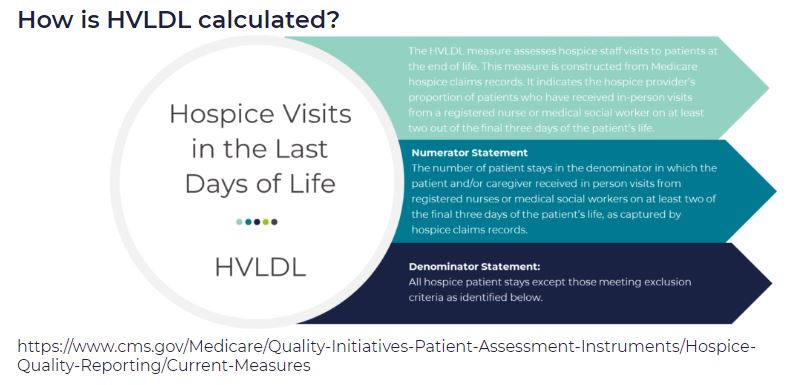

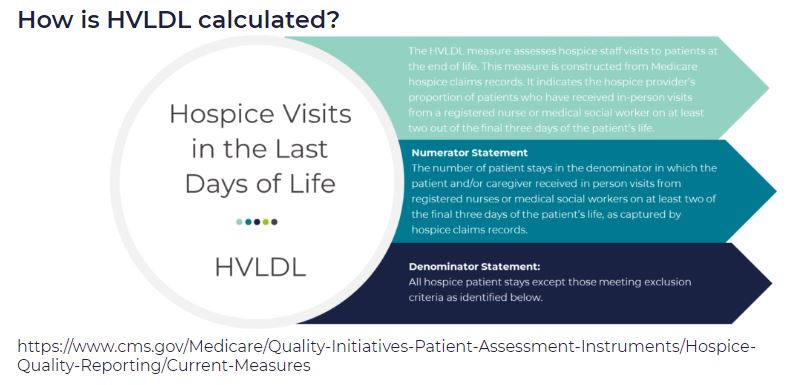

HVLDL is an HQRP claims-based measure of the proportion of patients who have received in-person visits from a registered nurse (RN) or a medical social worker (MSW) on at least two of the final three days of life. This metric replaces the HIS-based measure Hospice Visits When Death is Imminent (HVWDII).

CMS selected this metric as an important measure of quality since it is during these final days that patients most likely exhibit extreme symptoms of actively dying. This time period is also when patients most often exhibit signs of onset of clinical signs of dying. Finally, consistent visits in the final days of life are perceived as better level of care by the patient’s family.

How are the final three days of life defined?

For the purposes of HVLDL, the final three days of life are defined as:

- Day 1: day of death

- Day 2: day prior to death

- Day 3: day two days prior to death

How are days counted?

- This metric counts days, not visits

- If an RN and a MSW each visit the patient on the same day, this counts as a single day not as two visits, since the metric counts days not visits

- Telephonic visits do not count toward this metric, only in person visits

- Visits by LPN, chaplains, or other clinical staff do not count toward this metric

Which patients are included in the calculation of HVLDL?

All Medicare fee for service hospice patients are included in this metric with the following exceptions:

- Patients who did not die in hospice care

- Patients who received continuous care, respite care, or general inpatient care in the final three days of life

- Patients who were enrolled in hospice care for fewer than three days

Since HVLDL measures visits over the final three days of life, a patient must have been enrolled in hospice for at last three days to be included in the metric.

What are the data sources for this metric?

Data for HVLDL is calculated from Medicare claims data. Only data for Medicare fee for service patients who died while in hospice and who do not meet any of the exceptions listed above are included in the HVLDL calculation.

CMS calculates HVLDL using eight consecutive quarters of data. Hospice agencies with fewer than 20 “eligible patients” in the reporting period (where an “eligible patient” is defined as a patient who has died while under hospice care and does not fall under any of the exceptions listed above) are not assigned an HVLDL value. By including eight quarters of data, CMS is expanding the set of hospice agencies for which an HVLDL value will be reported. CMS will update the HVLDL value once each year.

How is the HVLDL metric calculated?

- The denominator is the count of all “eligible patients” during the reporting period

- The numerator is the count of all “eligible patients” who received an RN or MSW visit on at least two of the three final days of life

When was HVLDL introduced and where can patients and their families view the HVLDL value?

HVLDL was added to the HQRP in 2021 and began public reporting in 2022. The metric provides insight into care provided by the hospice agency in the days immediately leading up to patient death. HVLDL can be seen under the Quality of Patient Care section on the Care Compare website.

How can a hospice see its HVLDL value?

To support a hospice agency’s quality improvement efforts, CMS shares the agency’s HVLDL value in the Hospice Agency Level QM Report in CASPER. CASPER reports separately the numerator and denominator of HVLDL as well as the hospice observed percent – the agency’s HVLDL score. CASPER also reports on the national average HVLDL score and the agency’s percentile. Percentile rank indicates what percentage of agencies nationwide had a HVLDL score that was equal to or lower than the agency’s score. A hospice agency can benchmark its HVLDL score with the national average and the percentile rank. It can also trend its performance against its own HVLDL value over time.

Why did CMS replace the HIS HVWDII?

CMS implemented HVWDII in 2017. This metric measured hospice visits by non-clinical team members including LPN, chaplain, MSW, and hospice aides during the final seven days of a patient’s life. Analyzing the data collected by this metric, CMS found that HVWDII was unable to distinguish between high quality and low quality hospice agencies (i.e., it failed the CMS validity testing criteria). Consequently, CMS sought a replacement metric. The revised metric is also aligned with the Service Intensity Add-On (SIA) payment initiative (which incentivizes visits by RN and MSW near patient’s death). HVLDL has an added benefit that it is calculated based on claims data so it does not add a reporting burden for hospice agencies.

Where can you learn more?

Image from Medalogix

by editor | Nov 13, 2022 | Compliance and Regulatory - Directors, Documentation - Chaplains, Documentation - Nurses, Hospice 101 - Aides, Hospice 101 - Chaplain, Hospice 101 - Nurses, Hospice 101 - Social Workers, Intake, Medical Records, Metrics and KPIs, Rules and Regulations - Chaplains, Rules and Regulations - Nurses, Rules and Regulations - Office Team, Rules and Regulations - Social Workers

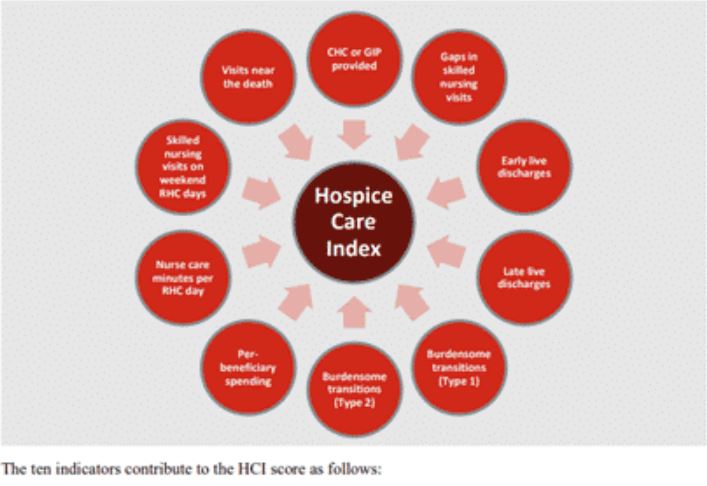

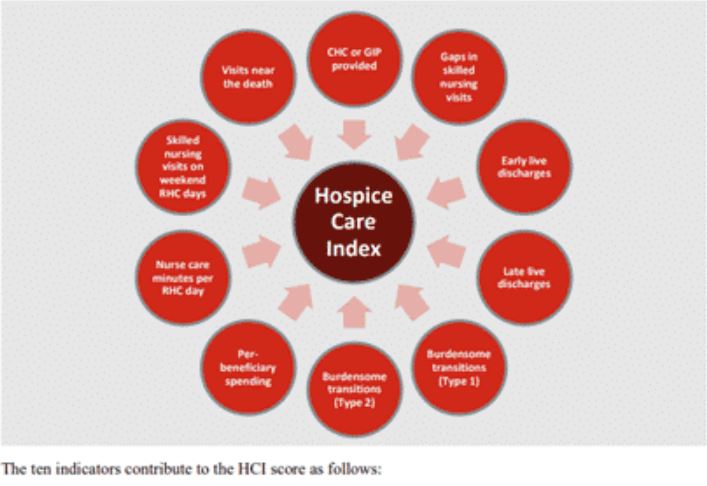

HCI is a single comprehensive metric reflecting ten indicators of care delivered during a hospice stay — from admission to discharge. This metric, which is included in the patient Care Compare portal, is intended to provide patients, families, and caregivers with an added metric to support informed healthcare choices.

What are the data sources for this metric?

HCI is calculated from Medicare claims data. A hospice agency does not need to submit any additional data to CMS for the calculation of this metric. The HCI metric captures care processes throughout the duration of a patient’s hospice care – from admission through discharge. Only data for Medicare fee for service patients who have been discharged from hospice is included in the HCI metric. CMS calculates HCI using eight consecutive quarters of data. Hospice agencies with fewer than 20 discharges in the reporting period are not assigned an HCI value. By including eight quarters of data, CMS is expanding the set of hospice agencies for which an HCI value will be reported. CMS will update the HCI metrics once each year.

What does the HCI metric measure?

HCI is a single comprehensive metric comprised of the following ten individual indicators of care.

- CHC/GIP provided

- Gaps in skilled nursing visits

- Early live discharges

- Late live discharges

- Burdensome transitions (Type 1)

- Burdensome Transitions (Type 2)

- Per-beneficiary Medicare spending

- Nurse care minutes per routine home care days

- Skilled nursing minutes on weekends

- Visits near death

Each indicator measures a different aspect of hospice care. A set of the HCI indicators measure the agency’s provision of higher level of care as needed and more frequent visits closer to the time of death, as measured by indicators

- Gaps in skilled nursing visits

- Nurse care minutes per routine home care day

- Skilled nursing minutes on weekends

- Visits near death

A set of HCI indicators measure patterns of live discharges and transitions, as measured by indicators

- Discharges from hospice followed by hospitalization and hospice readmission

- Discharge from hospice followed by patient dying in the hospital

- Early live discharges

- Late live discharges

Finally, an HCI indicator is used to measure appropriateness of use of the hospice benefit

- Per beneficiary Medicare spending

Medicare’s overall objectives of the HCI metric are twofold: (i) to ensure that all hospice patients are receiving the care that they need and (ii) to identify indicators of fraud.

How is the HCI metric calculated?

The HCI metric simultaneously monitors all ten indicators of care. The ten indicators are then combined into a single value between zero and ten, where ten is the highest value. Each indicator equally affects the HCI value, reflecting how each aspect of care delivered, from admission to discharge, shares the same level of importance.

Specifically, the hospice agency is awarded one point for each of the ten indicator criteria the agency meets. A hospice receives a point for an indicator if its value exceeds a prescribed threshold. The threshold is determined as a function of the overall values for that indicator across all hospice agencies. The more indicators a hospice agency meets, the higher the agency’s HCI value. The sum of the points earned from meeting the criterion for each indicator yields the agency’s aggregated single HCI value.

When was HCI introduced and where can the metric be viewed?

The HCI metric was added to the HQRP and began public reporting in 2022.

The single aggregate HCI metric can be seen under the Quality of Patient Care section on the Care Compare website.

The details of the HCI metric – including the values for each of the ten individual HCI indicators – can be found in the Provider Data Catalog.

How can a hospice see details about its HCI value?

To support a hospice agency’s quality improvement efforts, CMS shares the details of an agency’s HCI indicator scores in the Hospice Agency Level QM Report in CASPER. An agency can benchmark its indicator values with state and national averages. It can also trend its performance in each indicator over time.

Where can you learn more?

Image from Home Care Pulse

by editor | Oct 30, 2022 | Human Resources, Payroll

What is an exempt employee?

Exempt workers are paid on a salaried basis. Salaried employees receive a prespecified amount of compensation each pay period. Their salary may not be reduced because of changes in the amount of work performed or because of changes in the quality of work performed. Learn more about exempt employees here: Exempt vs. Non-Exempt Employees

May pay be deducted from an exempt employee’s wages?

Under the federal Fair Labor Standards Act (FLSA), employers may not deduct wages from an exempt employee’s wages due to partial day absences. However, an employer may deduct time from an exempt employee’s accrued Paid Time Off (“PTO”) or accrued vacation time for partial day absences. State laws may differ from the federal guidelines and each state may have its own regulations.

In general, if a salaried employee performs any work during the workweek an employer must pay the employee their full salary amount. However, there are a few situations where deduction from an exempt employee’s salary is permissible under federal law:

- A workweek where an employee performs absolutely no work

- The initial or final week of employment (where the employee did not work the full workweek)

- Absences of one or more days due to personal reasons, other than sickness or disability, including vacation

- To offset amounts the employee receives from jury or witness fees

- For leave taken under Family Medical Leave Act (“FMLA”)

- Unpaid disciplinary suspension of one or more days in accordance with documented workplace policies

Where can you find out more?

by editor | Oct 30, 2022 | Employee Onboarding, Human Resources, Payroll

The Fair Labor Standards Act (FLSA), enacted in 1938, has four major provisions: regulations for minimum wage, overtime pay, record keeping and child labor law. It also introduced standards for exempt and non-exempt employees. As it relates to the FLSA, exempt means free from an obligation of overtime pay. Note that FLSA regulates the Federal standards; the states may have different regulations in each of these areas.

What is an exempt employee?

Exempt employees are not eligible for minimum wage, overtime regulations, and other protections that are extended to non-exempt employees. Exempt employees receive a set salary every pay period. Exempt employees are typically salaried workers and often fill executive, supervisory, or administrative positions.

Which employees are covered under the FLSA law?

Enterprise Coverage: If a business is covered then all employees of the business are entitled to FLSA protection. What businesses are covered under enterprise coverage?

- Business has at least two employees and does sales of at least 500,000

- Named enterprise coverage: Hospital, business providing medical or nursing care for residents, school, preschool, or public agency, whether private or non profit

Individual Coverage: Individual employees in an organization may be entitled to FLSA protection even if the entire organization is not entitled to FLSA protection

- Individual is engaged in activity that involves working across state lines (interstate business) on a regular basis

- Domestic service workers (e.g., housekeeper, cook, babysitter)

Should an employee be classified as exempt or non-exempt?

- An employer should consider all employees as non-exempt and overtime eligible unless they can meet a specific exemption under federal or state law

- An employee who remains in the same job position should not move back and forth between exempt and non-exempt. Further, an employer cannot decide that they want to make an employee exempt. The regulations determine FLSA classification.

- Job title does not determine classification

Employers must correctly classify their employees as exempt or non-exempt or they run the risk of accruing compliance violations.

Can any worker qualify as an exempt employee?

An employer may wish to classify all employees as exempt employees – in this way avoiding the requirement to pay time and a half for overtime hours worked. However, not all employees are eligible to be classified as exempt employees.

The Department of Labor (DOL) has established guidelines to determine who is eligible to be considered exempt. The qualifications generally fall into three categories: salary exemption, nature of payment, and job duties. An employee must pass the tests in all three categories to qualify for exempt status.

Exempt employees test #1: total earnings

The first test to qualify an employee for exempt status is that the employee must earn the salary threshold set by the FLSA to be exempt. The minimum salary threshold of the FLSA changes every year. In 2021, the required minimum employee compensation to have exempt status was $684 per week ($35,568 per year). This salary threshold must be met regardless of being part time or full time. If the salary threshold is not met, the employee may not be classified as exempt (with an exception for teachers, doctors, and lawyers).

Exempt employees test #2: nature of payment

The second test to qualify an employee for exempt status is that the employee must be paid on a salaried basis, where compensation is not reduced due to quantity or quality of work.

Exempt employees test #3: job duties

The third test to qualify the employee for exempt status is whether the employee meets the job duties that qualify for exempt status. There are only certain job duties that qualify an employee for exempt status. These job duties involve a higher level of expertise or knowledge or require the employee to hold certain professional roles. There are several categories of job duties exemptions:

Executive exemption: employees who would qualify for an executive exemption would

- Regularly supervise employees

- Be responsible for managing part of the business

- Play a role in hiring employees or in delegating tasks

Administrative exemption: employees qualifying for an administrative exemption would

- Perform office jobs directly related to business operations or management of the organization and its customers

- Exercise independent judgement over business decisions

Professional exemption: employees qualifying for a professional exemption would

- Perform job duties that require specialized education

- Have a college degree or higher in their field

Computer exemption: employees with this exemption would

- Have a computer related role

Outside sales exemption: employees qualifying for this exemption would

- Have a primary duty of making sales or securing contracts or orders

- Conduct their work outside of the business’ premises

Where can you find out more?

by editor | Oct 29, 2022 | Human Resources, Payroll

How should an employer handle unclaimed wages?

An employer may find that an employee fails to cash a paycheck. Most often, this occurs with the final pay check. These “unclaimed wages” may not be treated as “found money.” When an employee fails to pick up a final check or fails to cash a check these unclaimed wages may become a form of “abandoned property.”

When is property considered abandoned?

Each state has its own definition of what it specifies as the abandonment period. That is, the time that each state requires that property must lay dormant before it is considered abandoned varies from state to state.

Once the unclaimed wages are considered abandoned, the employer must pay these unclaimed wages over to the state where the person last worked. The state steps into the shoes of the “lost owner” and takes ownership of the property until the rightful owner is found.

The state laws governing abandoned property are known as esheat laws because the property “escheats,” or reverts to the state and is not kept by the employer. Escheat laws are intended to give the employee an opportunity to claim the funds without having to track them down through corporate mergers or relocations,. Instead, the employee can go to the state to locate and claim the funds.

How long should an employer retain the funds?

Before an employer does anything with the unclaimed wages, the employer should check state laws to see how long the wages must be held, the employer’s obligations for locating the owner, when the employer must report the unclaimed wages to the state, and where the report must be sent to. In some states the wages are sent to the treasurer’s office. In other states the wages are sent to the attorney general’s office. States generally require that the employer holds the funds for at least one year.

Trying to locate the employee

Once an employer identifies unclaimed wages, the employer cannot simply transfer these funds to the state. The employer is obligated to make efforts to locate the employee. Employers must demonstrate that they have taken steps such as sending a tracked mailing (e.g., certified letter or UPS) to the employee’s last known mailing address or other method of contacting the employee using their last known contact information.

Most states require the employer to wait a minimum of six months after making these attempted notifications. Once the employer has complied with the statutory requirements – and can demonstrate that in the filing with the state – the funds may be returned to the state.

Reporting and remitting funds to the state

States have different reporting deadlines in the year. Some states use a date early in the following year after the dormancy requirement is met. Other states have a more accelerated deadline which would require advanced planning to ensure the deadline is not missed.

State unclaimed property laws also have detailed requirements, that vary by state, for remitting the funds to the state and for required supporting documentation.

Summing it all up: What is required of the employer?

Each state has its own unclaimed property rules and requirements.

Step 1: Document every contact you made with the employee

Most states require employers to show due diligence that they made all efforts possible to reach out to employees and give them the funds that they are owed in an attempt to keep unclaimed wages from becoming abandoned property

Step 2: File an annual report with your state

States typically require the employer to file an annual report including the employee’s name, last known address, amount and payment date of the unclaimed check, and the date of last contact with the employee

Step 3: Send the unclaimed wages with the report

With the report, the wages must be sent to the state. The state holds the money indefinitely (until claimed). The employer’s responsibility for paying the wages ends once the employer submits the wages and the report to the state.

Where can you find more information?

Recall that these laws vary by state and each state has its own requirements.

- National Association of Unclaimed Property Administrators (NAUPA) webpage has links to state websites: https://unclaimed.org/

- Search by state name and word “escheat”