by editor | Oct 13, 2024 | Compliance and Regulatory - Directors, Hospice 101 - Aides, Hospice 101 - Chaplain, Hospice 101 - Nurses, Hospice 101 - Office Team, Hospice 101 - Social Workers, Interdisciplinary Team, Regulatory Compliance, Rules and Regulations - Chaplains, Rules and Regulations - Nurses, Rules and Regulations - Social Workers

The hospice interdisciplinary group (IDG) creates a patient’s plan of care and provides holistic care to the patient, caregiver, and family. Hospice Conditions of Participation require the IDG to “review, revise, and document the individualized plan as frequent as the patient’s condition requires, but no less frequently than every 15 calendar days.”

As such, the IDG meet at a minimum every 15 days. In many hospice organizations, the interdisciplinary group meets weekly to review patient status and to determine if changes are required to a patient’s plan of care. It is important that during the IDG meeting patients’ care plans are reviewed and updated based upon patients’ assessments. Timely and accurate documentation is critical; this documentation may be reviewed by surveyors and by CMS to ensure compliance with regulations.

Who is required to attend an IDG Meeting

Required members of the IDG meeting include:

- A doctor who is an employee or under contract with the hospice agency

- Registered nurse

- Social worker

- Pastoral or other counselor

These four individuals are minimum participants in the IDG meeting. If one of these members i missing from the IDG meeting, the meeting does not meet Medicare regulations and it is considered as if the meeting did not take place. . Care must be taken to ensure that the minimum requirement – IDG meeting with the participation of at least these four individuals at a minimum of once every 15 days – is met.

Additionally, a staff member is typically identified to serve as the scribe for the IDG meeting. The scribe captures any changes to a patient’s plan of care that are agreed upon during the meeting.

What activities occur during the IDG meeting?

When the meeting begins, all participants sign the meeting sign-in sheet. These sheets serve as documented proof that the hospice has met the Medicare Conditions of Participation – that the required members of IDG participated in the meeting. Sign in sheets are stored in a place that is accessible for review upon the request of auditors or surveyors.

Prior to the IDG meeting, a list is drawn up of the patients who will be reviewed during the meeting. For each of these patient’s members of the care team provide an update on the patient’s current condition, highlighting any concerns. The team then discusses the plan for the upcoming two weeks.

Patients may be ordered for discussion as follows:

- Deaths

- Admissions

- Recertifications

- Evaluation

Let’s review each of these in detail.

Deaths

Each death since the prior IDG meeting is reviewed. The team discusses whether bereavement has been requested or declined. In the case where bereavement has been requested, the individuals who will be receiving bereavement services are identified. Any further details or concerns on the services that will be provided are discussed.

Admissions

The RN Case manager discusses any new admissions since the prior IDG meeting, including patient diagnosis and hospice eligibility criteria. Visit frequency is discussed, hospice aide services, and patient psychosocial needs. Typically, all team members partake in this discussion including a discussion about patient medications and prognostic indicators.

Recertifications

At this stage in the IDG the team discusses all patients who are the end of their benefit period and need to be recertified. Any face-to-face visits that were conducted will be discussed and any that are still pending will need to be scheduled. For patients who were evaluated and are found not to meet criteria, the team discusses how to notify the family and details on how to transition the patient off of hospice care.

Evaluations

All remaining patients on the list are reviewed by the members of the IDG. The team discusses whether any changes to the plan of care are needed, whether any medications need to be changed or if any additional support is required (e.g., chaplain, volunteer). The plan of care may be updated if the team agrees that a change in visit frequency is required.

Updating patients’ plan of care

While each patient is discussed, any changes to the patient’s plan of care are entered into the patient’s chart, which is signed by the medical director.

by editor | Mar 22, 2023 | Compliance and Regulatory - Directors, Metrics and KPIs, Rules and Regulations - Nurses, Rules and Regulations - Office Team

Patient length of stay is monitored to detect instances of inappropriate use of the hospice benefit or other deficiencies in the services delivered by the hospice provider. Length of stay is monitored for both very short length of stay as well as for length of stay that is longer than the norm.

What may unusual length of stay tell a hospice provider?

When patients are discharged alive with a short length of stay it may signal that the patient did not understand the hospice benefit when the patient was admitted to hospice. Or, patients may discharge live from hospice after just a few days because they were not satisfied with the services delivered by the hospice provider. Patients with length of stay longer than 180 days could be indicative of a patient who is no longer hospice eligible. Patients who are no longer eligible for service should be discharged from hospice and any payments that were received from Medicare while the patient was no longer eligible for services should be returned to Medicare. Failure to discharge the patient or failure to return the funds are examples of fraud and abuse.

How is length of stay calculated?

Length of stay is calculated based on the number of days that a patient receives hospice care. Specifically, for a patient who is discharged from hospice (whether or not the patient is discharged alive), the patient length of stay is calculated as follows:

Patient length of stay = [patient discharge date]-[patient admission date]+1

Which patients are included in length of stay calculation?

The length of stay calculation assumes that only discharged patients are considered in the calculation – since the formula expressly refers to the patient discharge date. When only discharged patients are considered (whether live discharges or discharges due to death), the hospice provider only has a backward-looking view on performance relating to length of stay. For example, if a hospice provider has been providing service to a patient for 12 months and the patient is still on service, the patient will not be included in the traditional average length of stay metric – since the patient has not yet been discharged. On the other hand, once the patient is discharged the patient’s length of stay will be at least 365 days since the patient – while still currently active – has already been on service for 365 days. If active patients are considered in a length of stay calculation, it gives a hospice provider a metric that can be used to highlight patients whose clinical charts and documentation of care may benefit from additional review.

What length of stay metrics should be calculated?

In addition to computing average and median length of stay based on discharged patients only, average and median length of stay can be computed for active patients. Patient length of stay for an active patient is calculated as follows:

Active patient length of stay = [end of evaluation period date]-[patient admission date]+1

For example, suppose the current date March 15, 2023 and a hospice wishes to calculate the active patient length of stay as of the end of 4Q 2022 for a patient who was admitted on December 1, 2022. The calculation is as follows:

- End of evaluation period date: 12/31/22

- Patient admission date: 12/1/22

- Active patient length of stay = (12/31/22) – (12/1/22) + 1 = 31 days

The active patient length of stay as of the end of 4Q 2022 is 31 days.

If the hospice wishes to calculate the active patient length of stay as of current date, the calculation is as follows:

- End of evaluation period date: 3/15/23

- Patient admission date: 12/1/22

- Active patient length of stay = (3/15/23) – (12/1/22) + 1 = 105 days

Average and median length of stay would be computed as usual. If any concerning value — such as long length of stay – is identified based upon the active patient length of stay, a hospice provider can immediately investigate and determine if any remediation action is required, rather than waiting until patients are discharged. Delay can lead to additional fines or further action from Medicare.

by editor | Mar 22, 2023 | Compliance and Regulatory - Directors, Metrics and KPIs, Rules and Regulations - Nurses, Rules and Regulations - Office Team

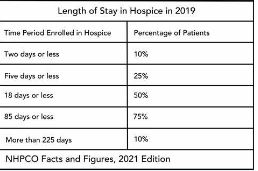

Patients are eligible for hospice if they have a terminal diagnosis and a prognosis of six or fewer months to live if their disease runs its natural course. A patient who lives longer than six months can still get hospice care if the medical director or other hospice physician recertifies that the patient is still terminally ill.

What is hospice patient length of stay?

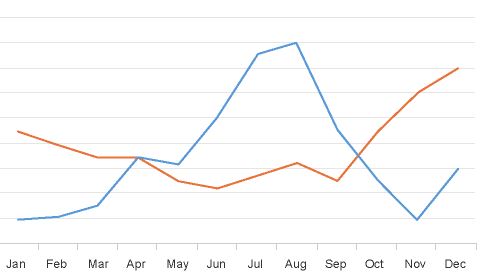

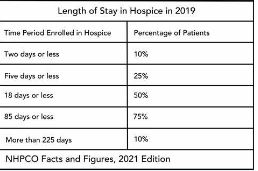

Hospice length of stay is an important metric that is monitored by both CMS and by hospice providers. Hospice length of stay measures the count of days that a patient receives hospice services, from the day that the patient is admitted into hospice until the day the patient is discharged (either alive or deceased). In 2018, 25% of Medicare beneficiaries received hospice care for seven days or less and 54% of Medicare beneficiaries received hospice care for 30 days or less.

Why should a hospice monitor patient length of stay?

Monitoring patient length of stay can aid in detecting cases of possible fraud or abuse – instances where ineligible patients continue to receive the hospice benefit. This metric also helps monitor whether the hospice benefit is being adequately utilized. Although patients are eligible for hospice when they have six months or less to live, most patients receive less than 30 days of hospice care.

Agency patient length of stay is also trended over time and is also compared against the value for patients in the same region, state, or nationwide. The metric may also be analyzed for patients in subpopulations – for example patients with the same disease, race, or ethnicity.

How is patient length of stay calculated?

Patient length of stay is calculated using all patients discharged by the hospice provider during the reporting period. For example, if the hospice would like to compute the length of stay for patients during the 4Q 2022, all patients who were discharged during 1Q 2023 would be included in the calculation. For each patient, the number of days from the date of patient admission until the date of patient discharge is counted; this represents the patient length of stay.

Patient length of stay = [patient discharge date]-[patient admission date]+1

What are common measures of length of stay?

Two common patient hospice length of stay measures are Average Length of Stay (ALOS) and Median Length of Stay (MLOS).

Average length of stay

Average length of stay is the arithmetic mean of the data collected. Specifically, if d is patient length of stay and N is the total number of patients then average length of stay (ALOS) is calculated as follows:

ALOS = ( d1 + d2 + d3 + …. + dn ) /N

Where di = patient length of stay for patient i

Median length of stay

Median length of stay is the middle number in the sequence of numbers. Specifically, compute the length of stay for all N patients. Then, order these N numbers in ascending order. The middle number is the median. If the number of patients is even then there is no middle number. Instead, the median is calculated by taking the average of the two numbers in the middle.

Comparing average and median length of stay

The average is sensitive to outliers in the data. That is, if there are a few patients with a very high length of stay while all other patients have a significantly lower length of stay, the average will be biased by these outliers and will give a misleading assessment of overall patient length of stay. Below, we give an example to provide greater intuition into the impact of outliers on average length of stay and the difference between mean and median length of stay.

Suppose a hospice agency discharged 35 patients during 4Q 2022. The patients’ lengths of stay are as follows:

We compute the average length of stay by summing each of the 35 patient’s length of stay (in the “Length of Stay” column) and dividing that total by 35 (the total count of patients).

Average length of stay (ALOS) = 38.5

We compute the median length of stay by sorting the patient’s length of stay in ascending order and identifying the central number. Since there is an odd number of patients, there will be a single central value. In this case, the central value is 20.

Median length of stay (MLOS) = 20

Average length of stay is almost double the median length of stay. What is leading to these significant differences between ALOS and MLOS? Observe the outliers in the data. There are two patients with length of stay that exceeds 200 days. There are two additional patients with length of stay exceeding 100 days. Since ALOS is sensitive to outliers, ALOS is being pulled to a higher value due to the presence of these outliers.

To provide additional insight, we have plotted a histogram of the length of stay values. A histogram shows the count of observations in the data that fall in each of the specified ranges.

The table on the left shows the count (frequency) of observations of patient length of stay in the data for each of the ranges: 0-10 days, 10-20 days, 20-30 days, 30-40 days, and greater than 40 days. There are 11 patients with length of stay between 0-10 days, 7 patients with length of stay between 10-20 days, 6 patients with length of stay between 20-30 days, 6 patients with length of stay between 30-40 days, and 4 patients with length of stay that exceeds 40 days.

Think about this histogram and now consider the MLOS and ALOS. Median length of stay is 20 days – it falls well in the middle of the data. Average length of stay, however, equals 38.5. It falls, essentially, in the final bar of this histogram and well beyond where the majority of the data lies. The provides a visual demonstration of the impact of outliers on ALOS.

Providers should monitor both ALOS and MLOS. Significant differences between these numbers would indicate the presence of outliers and should be investigated.

Print ‘n take hospice keys

- Understanding the difference between the average (mean) and the median

hospiceKeys-meanVsMedian

Where can you find out more?

by editor | Jan 29, 2023 | Billing, Documentation - Nurses, Hospice 101 - Aides, Hospice 101 - Chaplain, Hospice 101 - Nurses, Hospice 101 - Office Team, Hospice 101 - Social Workers, Intake, Rules and Regulations - Nurses, Rules and Regulations - Office Team

What is the False Claims Act?

The False Claims Act (FCA) was established in 1863 during the Civil War to combat fraud and abuse perpetrated by suppliers of the federal government. At that time, the law was referred to as “Lincoln’s Law.”

The FCA has evolved significantly in recent years and is now one of the main tools used by the government to fight fraud. The FCA penalizes individuals or entities that submit fraudulent claims to the government, cause fraudulent claims to be submitted, or conspire to submit fraudulent claims.

One of the noteworthy provisions of the FCA is the qui tam provision, also known as the whistleblower provision. The qui tam provision allows private citizens, also referred to as “relators”, to report details of alleged fraud to the government. The whistleblower “stands in the shoes” of the government to prosecute the claim. This action benefits the government and the taxpayer as well as potentially the relator, who may receive a share of what is recovered.

How does the FCA relate to a hospice agency?

The False Claims Act allows hospice agency employees, patients, families of patients, or any individuals with alleged knowledge of fraud or abuse by the agency to report the behavior. Under the qui tam provision of the FCA, the relator may be entitled to a percentage of recovered funds.

What are different types of false claims?

A claim is a request for money made to the government. A false claim is money that is obtained from the government due to false or fraudulent claims. False claims include claims where the service

- Has not been provided

- Is already included as part of a different claim (i.e., double billing)

- Is not coded correctly

- Is not supported by the patient’s medical record

Claims may also be false and are covered under the FCA if they result from a referral made in violation of the Federal Anti-kickback statue (Stark Law).

The False Claims Act also includes payment from the government based upon false certification.

False claims include claims that the hospice agency should have known were false or fraudulent.

What is a claim that a hospice agency “should have known” is false?

The FCA expressly includes claims that a hospice agency “should have known” were false or fraudulent. “Should have known” means deliberate ignorance or reckless disregard of truth. As such, a hospice agency cannot avoid liability by simply ignoring inaccuracy in their claims. Examples of “should have known” include:

- Ignorance of billing rules, i.e., lack of knowledge of the rules

- Failure to act on consistent trends that are indicative of inaccurate billing

- Failure to act on inaccuracies or system errors identified by outside or internal auditing teams

- Failure to correct inaccurate billing (impacting either past or future claims)

A hospice agency must understand the rules and take proactive measures — such as conducting internal audits within the organization — to ensure compliance and accurate billing.

How can False Claims Act matters be initiated?

There are two ways that FCA matters can be initiated:

- Initiated by the government: When a FCA matter is initiated by the government, this type of matter typically starts with an audit or an investigation by the government. The government would determine that there is a false claim made to it and would initiate a matter, usually by a subpoena or civil investigative demand (CID). The government would issue the CID directly to the hospice agency. CID is a form of subpoena that requires the hospice agency to engage in one-sided discovery. That is, the hospice agency is required to produce documents demanded, respond to interrogatories, and provide sworn oral testimony. However, the hospice agency may not conduct any discovery.

- Qui tam matter: this type of matter is initiated by a whistleblower, also known as a “relator,” typically through the filing of a sealed lawsuit in a federal district court. The hospice agency does not know about the qui tam lawsuit since the lawsuit is initially served on the government. The case remains under seal while it is investigated by the government.

What is the qui tam process?

Qui tam actions are initially filed under seal. That is, only the US Attorney and some members of the Department of Justice (DOJ) have knowledge of and access to documents related to the case. The relator serves the complaint on the government together with a written disclosure of all material evidence.

The purpose of the sealed qui tam action is to allow the DOJ time to evaluate the relator’s allegations and for the DOJ to decide whether it would like to take over primary responsibility for prosecuting the case. If the DOJ decides to take over primary responsibility for the case, the DOJ is said to “intervene.”

The complaint remains under seal for 60 days during which time the DOJ investigates the relator’s allegations. This 60-day period can be (and typically is) extended. In fact, the government may spend months – or even years – investigating the case.

While the DOJ conducts its investigation, it may issue a Civil Investigative Demand (CID). This form of subpoena requires the defendant (the hospice agency) to engage in one-sided discovery where the hospice agency must produce documents, respond to interrogatories, and provide sworn oral testimony, as demanded. The CID is “one-sided discovery” because the hospice agency may not conduct any discovery.

If the government decides to intervene, the government is then responsible for litigating the case and files its own complaint instead of the complaint that was filed by the relator. The relator remains a party to the complaint.

If the government declines to intervene, the relator may proceed in her own name subject to the government’s right to dismiss the claim or to intervene at a later date.

Whether or not the government decides to intervene, the government remains the real party of interest. (As a reminder, the relator is only “standing in the shoes” of the government.) As such, the government must agree to any decisions on the case. The relator may not agree to dismiss or settle the case without the government’s approval.

What are the key phases in a False Claims Act investigation?

- Phase 1: FCA investigation is triggered. Triggers may include:

- Qui tam (whistleblower) lawsuit

- Call to OIG hotline

- Information identified during audit or claim review

- Complaints

- Data mining

- Phase 2: Formal investigation launches. Investigation may involve:

- Review of corporate filings

- Interview current or former employees

- Review financial records

- Electronic surveillance

- Physical surveillance of employees or of company premises

- DOJ civil investigative demand (CID), or the like

- Government search warrant or raid

- Phase 3: Litigation or resolution

Who are common whistleblowers?

Anyone can be a whistleblower and anyone may report alleged fraudulent activity to the government. The most common relators are:

- Business partners

- Current or former employees

- Competitors

- Patients

- Individuals who mine CMS data to identify anomalies/FCA claims

How can a hospice agency reduce the chance of qui tam lawsuits?

Any complaints or concerns that are raised – by employees, vendors, patients, or competitors, or any other individuals should be investigated and treated with concern as these have the potential to reveal compliance issues that need to be resolved by the hospice agency.

Employee complaints – whether from departing or active employees – are often an excellent source of information on potential compliance issues. A hospice agency should have a clearly established method – that is clearly and often communicated to employees – for employees to raise concerns. It should also have an organized process to diligently investigate and address any concerns raised by employees.

- Internal complaints:

- There must be an organized process – that is communicated regularly to employees – for employees to raise concerns

- All concerns must be investigated

- Have a plan to address any issues that are identified

- Take any necessary corrective actions

- Follow up with the individual who raised the complaint

- Provide training, as needed

- Departing employees

- Treat employees fairly as they leave

- Conduct exit interviews to identify any potential compliance concerns – investigate any issues that may be identified

- Potential releases (e.g., recovery from FCA claims)

Employees must feel that there is a process for raising concerns and that their concerns are heard. Employees should not fear retaliation for raising concerns. A hospice agency should be diligent and careful to respond to all employee complaints that are raised internally or to any complaints that are raised when employees leave the organization.

What are the financial benefits of avoiding FCA violations?

False claims act matters can be quite costly for a hospice organization. In addition to returning the payments associated with the false claims identified and incurring the costs associated with attorney fees to defend the matter, the hospice agency potentially faces the following significant costs:

- Treble damages: The FCA has a treble damages provision which provides that a hospice agency that is found to have violated the FCA statute may be liable to pay three times the amount of the actual false claim amount

- Penalty per claim: Under the FCA, a civil penalty may be assessed for each false claim that is submitted. The civil penalty dollar amount per claim has increased with inflation and currently may be as much as $23,000 per claim.

Where can you find more information?

by editor | Jan 28, 2023 | Compliance and Regulatory - Directors, Documentation - Nurses, Hospice 101 - Nurses, Metrics and KPIs, Rules and Regulations - Nurses

What is a UPIC?

Unified Program Integrity Contractors (UPICs) are contracted by CMS to conduct detailed medical review, data analysis, and audits of healthcare providers to investigate possibilities of Medicare or Medicaid fraud, waste, and abuse.

While the primary purpose of a RAC or MAC audit is to review payments, the primary purpose of a UPIC audit is to investigate when there is suspicion of fraud – especially fraudulent billing practices. A UPIC audit can lead to federal Medicare fraud charges or criminal prosecution. As such, UPIC audits are more serious than other audits.

What is a UPIC’s scope of responsibility?

Prior to UPICs, Zone Program Integrity Contractors (ZPICs) had been responsible for performing fraud, waste, and abuse detection and prevention activities for CMS. In 2016, CMS began to transition to the UPIC program. This transition took a number of years, with ZPIC contracts rolling over to the UPIC program as ZPIC contracts expired. The ZPIC program has now been phased out and replaced with UPICs. UPICs were formed as part of the Comprehensive Medicaid Integrity Plan (CMIP) with the intention of consolidating under a single federal contractor work performed by numerous Medicare and Medicaid program integrity contractors. UPICs combine all federally funded integrity reviews into a single audit and place payments to all federally funded payers under a higher level of scrutiny.

Consolidating responsibility provides UPICs with access to more data and information about healthcare claims, billing, and payments to hospice agencies. By increasing the level of information and data to which UPICs have access, UPICs have improved ability to identify billing anomalies and fraud.

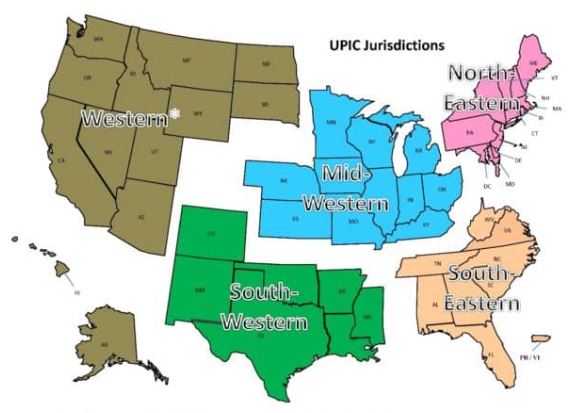

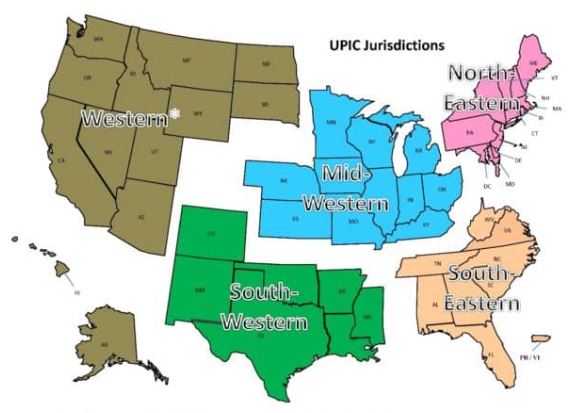

With respect to regional responsibility, the United States has been split into different geographic jurisdictions: Western, Mid-Western, North-Eastern, South-Eastern, and South-Western. Each UPIC is responsible for handling federal-level audits for both Medicare and Medicaid in one of the different geographic jurisdictions.

How is a hospice agency targeted for a UPIC audit?

UPIC audits are usually triggered by statistical analysis of hospice claims and billing data that identifies anomalies in in a hospice agency’s billing. Factors that often lead to a hospice being targeted for a UPIC audit include:

- Billing trends that are inconsistent with industry trends

- Long inpatient stay

- Referral from law enforcement or a federal agency. (For example, a hospice agency may be referred to a UPIC if at the conclusion of a MAC investigation for improper billing, the findings cannot be classified as billing errors or misunderstandings.)

- Complaints to the OIG

- Inaccurate Medicare billing

- Greater frequency of high end services as compared with local or national averages and patterns

What activities may be involved in a UPIC auditor’s investigation?

UPIC audits are focused reviews. A UPIC will request medical records and conduct interviews to determine whether fraud has occurred.. The UPIC’s audit process typically consists of a detailed review of the hospice’s records to confirm all Medicare billings. A UPIC auditor’s activities may be varied and may extend well beyond a review of medical records and documentation including activities such as:

- On site visit

- Interview hospice patients and/or hospice agency employees

- Review clinical, financial, and time production records

- Perform data analysis

- Look for prior agency violations

How does a UPIC audit progress?

A UPIC audit will typically begin with a letter requesting submission of documents – typically within 30 days but sometimes within 15 days. Most UPICs will agree to an extension of time for document submission.

A hospice agency should carefully review the nature of the request. Is the UPIC only requesting administrative and claims related medical records or is the UPIC also requesting documentation relating to the hospice agency’s business practices?

If the UPIC requests information about the hospice agency’s business practices or business relationships – such as its referral sources – this may indicate that the UPIC received information that the hospice agency is engaged in questionable business practices. If the UPIC identifies improper practices, the hospice agency will be referred to the Office of the Inspector General (OIG) or Department of Justice (DOJ).

If the UPIC only reviews claims and the associated medical or billing records, then there are typically two cases:

- Case 1 – The UPIC requests ten or fewer post-payment claims: the UPIC is likely conducting a “Probe Sample”. The purpose of a probe sample is to check if there are problems with the hospice agency’s billing practices, medical necessity, or documentation. This means that the data analyst identified a potentially problematic pattern following the data analysis. The investigator was notified of this pattern and a sample of claims is requested that match the identified pattern. If no significant problems are identified in the initial sample of claims, the UPIC typically issues an “Education Letter”. If numerous problems are found, the UPIC usually expands its audit and issues a request for a larger sample of 30 or more claims.

- The auditor will extrapolate based upon the findings of the 30 or more claims. Extrapolation allows the auditor to identify the error rate in the sample, and then extrapolate the error rate over the entire universe of six years of claims. (Six years is the maximum look back period for claims review.) For example, if the auditor collects a sample of 50 claims and errors are identified in 10 claims, then the error rate is 10/50=20%. It is then assumed that the accuracy of the billing identified in the sample is indicative of the entire universe. Consequently, the error rate of 20% identified in the sample is applied to the entire universe. Even if the hospice agency changed processes, billing software, or billing staff during the duration of time period of the universe, the sample error rate is still applied to the universe. As such, the impact of extrapolation is often quite significant.

- Case 2 – The UPIC requests 30 or more claims: the UPIC likely selected these claims as part of a “Statistically Relevant Sample” and will extrapolate the error rate that it finds to the entire universe of claims.

UPICs also conduct unannounced office visits to hospice agencies. If an office visit occurs, the UPIC will arrive at the office site with written request for patient medical records. They will also interview patients and hospice agency workers.

What may be the outcome of a UPIC audit?

A UPIC audit may result in payment suspension if there are findings that indicate the existence of overpayment, incorrect billing, or fraud.

When a hospice agency is faced with payment suspension, it may follow the standard Medicare appeals process. Legal counsel may be helpful in guiding a hospice agency regarding rights as applied to recoupment and claims withholding.

Payment suspension sometimes occurs without prior notice to the hospice agency. If the agency receives prior notice, it has 15 days to rebut. The UPIC must respond within 15 days of receiving the rebuttal. CMS then determines if the suspension should be removed. In most cases, the suspension remains in place.

Initial payment suspension can last up to 180 days with two unappealable 180 day extension periods.

A hospice may continue to provide services and submit claims while payments are suspended. During the suspension period, payments are not made to the hospice. Instead, payments are made to an escrow account that is managed by the UPIC.

If overpayments are identified, they are taken from the escrow account. The balance remaining in the escrow account is returned to the hospice agency once the audit is completed.

If the UPIC identifies any fraudulent behavior, the activity is referred to the Department of Justice (DOJ) or to the Office of Inspector General (OIG).

What if a hospice agency disagrees with UPIC findings?

A hospice agency may appeal overpayments identified by the UPIC through the Medicare administrative appeals process.

How can a hospice agency prevent UPIC audits?

By increasing their compliance efforts and activities, hospice agencies can prevent UPICs and decrease the chance of a negative outcome from a UPIC audit. More specifically,

- CMS requires that every hospice agency have a compliance team. In addition, compliance reporting duties must be defined.

- A hospice’s compliance plan must be kept current and should include

- How to update coverage guidelines from CMS

- Billing protocols

- Staff hiring and training on protocols

- Documentation guidelines

- HIPAA information and training

- Protocols for cross checking Medicare and Medicaid claim data

- Hospice compliance teams should conduct periodic and random internal audits of patient records, billing documentation, and required signatures. Compliance teams should look out for persistent errors and indications such as is additional biller training is required – either for the team or for a specific biller? Or, is there a new regulation that the team is not familiar with? Is there a physician who is consistently late with signatures? A clinician whose documentation does not look complete or timely? Charts should be audited randomly but on an ongoing basis and indications of the need for self-disclosure should be followed up on. Self-disclosure results in overpayment, but it typically removes a hospice agency from being a target for UPIC audits since it is an indicator that the hospice conducts internal self-audits and returns overpayments, as necessary.

- Hospice agencies can hire third party auditors to conduct chart and coding audits. These third-party auditors can suggest improvements to billing processes or hospice operations to improve compliance with regulations.

- Track all payer document requests and reimbursement denials; these may help identify billing problems before they are identified by an auditor.

Where can you find out more?

by editor | Jan 28, 2023 | Compliance and Regulatory - Directors, Documentation - Nurses, Hospice 101 - Nurses, Metrics and KPIs, Rules and Regulations - Nurses

What is a TPE?

A Targeted Probe and Educate (TPE) is an audit program that was rolled out by CMS in 2017. The stated goal of this program is to help providers reduce claim denials and appeals. The TPE works to achieve its goal by educating providers in topics that will help to eliminate common mistakes that lead to recoupment of Medicare payments.

Through the TPE program, CMS (through the MAC) works directly with the hospice agency to identify errors and

- Assist or direct in correcting the errors

- Assist to quickly improve when errors are found

- Provide one-on-one help or education

TPE audits are not random spot checks. They are targeted audits. A hospice is identified based upon MAC data analysis or claim review. A hospice with high error rates or unusual billing practices may also be selected for a TPE. TPEs often focus on items with high national error rates. TPEs also focus on items that pose financial risk to Medicare.

TPEs target hospice agencies that fall within these identified risk categories. A hospice agency that is compliant with Medicare policies and billing practices will not be selected for a TPE.

What is the TPE audit process?

The TPE audit process begins with a Notification Letter sent from the MAC to the hospice agency. The Notification Letter explains the TPE program and informs the hospice agency that it has been selected for a TPE audit. It also explains the reason that the agency was included in the TPE and advises that an additional documentation request (ADR) is forthcoming. No response to the Notification Letter is required.

TPE Round 1

The ADR arrives following the Notification Letter. The ADR includes a list of 20-40 claims for which medical records and documentation supporting the claims are requested. This is considered Round 1. The hospice agency must submit the requested documentation.

The MAC reviews the documentation supporting the 20-40 claims to determine if the documentation supports the claims that were submitted.

If the hospice agency is deemed compliant (“no unfavorable findings”) after review of the documents submitted in response to the ADR in round 1,

- Round 1 ends

- No further reviews on that topic for at least one year

If there are unfavorable findings (issues are noted):

- One-on-one educational sessions are offered to the provider

The hospice should participate in the one-on-one education. This education provides the hospice agency with an opportunity to speak directly with the auditor and discuss the errors identified. During these sessions, the MAC guides the hospice agency through error correction. Following the education there is a 45 day period for the hospice to make improvements (e.g., system improvements, process improvements) before another TPE review by the MAC. If the MAC is satisfied that the errors have been corrected, the audit is closed. However, if more errors are identified the hospice agency will be entered into another audit round.

TPE Round 2

A second ADR is sent requesting another 20-40 claims. The hospice agency submits the documentation which is again reviewed by the auditor. The process followed in TPE Round 1 repeats. If there are unfavorable findings, the TPE advances to Round 3.

TPE Round 3

A third ADR is sent requesting another 20-40 claims. If there are still unfavorable findings in Round 3, the hospice agency is referred to CMS for next steps including:

- Shift to 100% prepay review

- Referral to a RAC

- Extrapolation/recoupment

- Other action, as instructed by CMS

What is the MAC looking for in the TPE audit?

During the TPE audit, the MAC is looking for billing mistakes that cause hospice agencies to be non-compliant with regulations. The most common problem identified during a TPE audit is that the documentation does not support terminal prognosis of six months or less.

What if a hospice agency disagrees with the audit findings?

If a hospice agency disagrees with the audit findings, the agency can appeal the results through the Medical Appeals Process. The hospice agency will need to request a redetermination of overpayment by the MAC.

Where can you find out more?