by editor | Sep 29, 2022 | Billing, Billing - General, Compliance and Regulatory - Directors, Financials, Rules and Regulations - Office Team

What is Medicare credit balance?

A Medicare credit balance represents a Medicare overpayment to a provider due to patient billing error or claims processing error that must be refunded to Medicare. The report is referred to as a Credit Balance Report because when a provider receives excess payment for a claim that was submitted, this is typically reflected in the provider’s accounting records (i.e., in the patient account receivable) as a “credit.”

What instances may give rise to a credit balance?

Different situations may give rise to a Medicare overpayment. For example:

- Paid twice by Medicare or may be paid by Medicare and by another insurer for the same service

- Incorrect calculation of patient deductible or patient coinsurance amount

- Paid for non-covered services

- Billed at incorrect daily rate

Which hospice agencies must file a Credit Balance Report?

If a hospice provider has more than one provider number, a separate report must be submitted for each provider number. Providers who have a low utilization (i.e., determined by the intermediary that they should file a low utilization Medicare cost report) or who file less than 25 Medicare claims per year are not required to file a Medicare Credit Balance Report.

What does a credit Balance Report Consist of?

The Credit Balance Report consists of two pages. The first page is a Detail Page, where the hospice provider enters information about each credit balance, on a claim by claim basis. Once a claim has been reported on one Credit Balance Report it should not be reported again on a subsequent Credit Balance report. The second page is a Certification Page. All providers must complete the Certification Page. The Detail Page is only required if the provider has credit balances to report.

The Detail Page

On this page, the provider must include detailed information about each Medicare claim with a credit balance, explanation why the credit balance arose, and indicate whether the credit balance is being repaid with the filing of the report.

The Certification Page

The second page of the Credit Balance Report is a certification page. Facilities that do not have any credit balances in a quarter are only required to submit the signed certification page. There are key areas of this page.

- The first area serves as a reminder that there is a requirement to file a Credit Balance Report and failure to file this report will result in suspension of Medicare payments. Further, any misrepresentations may lead to fines and further penalties

- The second area requires an officer or administrator of the hospice agency to sign a certification that that Credit Balance Report is true and accurate

- The third area requires a selection from one of three choices: (i) provider qualifies as Low Utilization Provider (ii) Detail Page included with Report (iii) no credit balances to report

When is the report due?

A hospice provider must assess any Medicare credit balances on a quarterly basis and must report any identified Medicare credit balances within 30 days of the end of each calendar quarter. The Medicare Credit Balance Report due dates are as follows:

| Quarter Ending |

Due Date |

| March 31 |

April 30 |

| June 30 |

July 30 |

| September 30 |

October 30 |

| December 31 |

January 30 |

What happens if a provider fails to submit a Credit Balance Report?

Failure to submit a Credit Balance Report by the 15th calendar day after the report due date will result in a Suspension Warning letter. If the completed report is not received within 15 calendar days from issuance of the letter, Medicare payments to the provider are suspended under a completed letter is received, accepted, and processed.

Where can you find a Credit Balance Report form?

The Credit Balance Report that must be completed and submitted is Form CMS-838, which can be found here: Medicare Credit Balance Form (pdf)

by editor | Sep 20, 2022 | Billing, Billing - General, Compliance and Regulatory - Directors, Financials, Intake, Notice of Election, Rules and Regulations - Nurses, Rules and Regulations - Office Team

by editor | Sep 15, 2022 | Accounts Payable, Billing, Billing - General, Compliance and Regulatory - Directors, Documentation - Nurses, Hospice 101 - Aides, Hospice 101 - Chaplain, Hospice 101 - Nurses, Hospice 101 - Office Team, Hospice 101 - Social Workers, Human Resources, Intake, Medical Records, Metrics and KPIs, Office Setup, Payroll, Rules and Regulations - Chaplains, Rules and Regulations - Nurses, Rules and Regulations - Social Workers, Rules and Regulations - Volunteers

Are you confused by the Acronym Alphabet Soup?

Does the never ending list of acronyms used in the hospice and healthcare industry leave you confused?

Are you worried that you may confuse CMN with CMP?

To help sort out the confusion, we add here links to lists of acronyms:

Use these acronym listings to help clarify things when you inevitably are faced with acronym confusion!

by editor | Sep 12, 2022 | Billing, Billing - General, Compliance and Regulatory - Directors, Documentation - Nurses, Financials, Hospice 101 - Nurses, Intake, Medical Records, Metrics and KPIs, Notice of Election, Rules and Regulations - Nurses

A hospice must file a Notice of Election (NOE) within five days after the beneficiary’s hospice admission date.

What is considered timely filing of an NOE?

For an NOE to be considered timely:

- The NOE must have a receipt date within five calendar days after the hospice admission date

- The NOE must process and finalize in status/location P B9997

For example:

- Patient admitted on 5/8

- NOE submitted on 5/13

- NOE processed on 5/27

To be timely, the NOE must have a receipt date of 5/13 and the NOE must subsequently process (P B9997)

However, if the NOE is not filed timely, Medicare will not cover and pay for the days of hospice care from the date that the patient is admitted until the date the NOE is submitted and accepted. For example:

- Admission date: 5/1

- NOE receipt date 5/10

- NOE processed 5/18

Non covered days: 5/1 through 5/9 (one day before NOE receipt date)

- Admission date 5/1

- NOE receipt date 5/10

- NOE processed 5/18

Non covered days: 5/1 through 5/9 (one day before NOE receipt date)

What happens if a hospice must resubmit an NOE due to errors?

Sometimes an NOE is submitted but it is not accepted due to a need for corrections. The NOE is “RTPd” (Returned to Provider) and is then resubmitted by the hospice. The date that the NOE is resubmitted by the hospice is considered the submission date.

How should a hospice file a claim if the NOE was filed late?

If a hospice has a late NOE, the claim must be filed showing the late filed NOE. It must also show occurrence code OSC 77, indicating the non covered dates. The claim will have two rows, one row for the non-covered days and one row for the covered days.

See Submitting Claims for Untimely NOEs for more details on billing when NOEs are untimely.

For more information on submitting claims, read some of our posts here Hospice Keys Billing Blogs

by editor | Sep 12, 2022 | Billing, Billing - General, Compliance and Regulatory - Directors, Financials, Metrics and KPIs, Office Setup, Rules and Regulations - Nurses

A Medicare Administrative Contractor (MAC) is a private health care insurer that has been awarded a geographic jurisdiction to process Medicare Part A and Part B medical claims for Fee For Service (FFS) beneficiaries.

CMS relies on these contractors to serve as the primary operational contact between the Medicare FFS program and the health providers enrolled in the program.

MACs are multi-state regional contractors who are responsible for administering Part A and Part B claims.

What types of MACs are there?

There are two types of MACs: Part A/B MACs and DME MACs.

Hospice claims are administered by Part A/B MACs. Part A/B MACs process about 95% of all FFS claims.

There are 12 Part A/B MACs.

Four of the MACs specialize in processing claims for hospice and home health providers

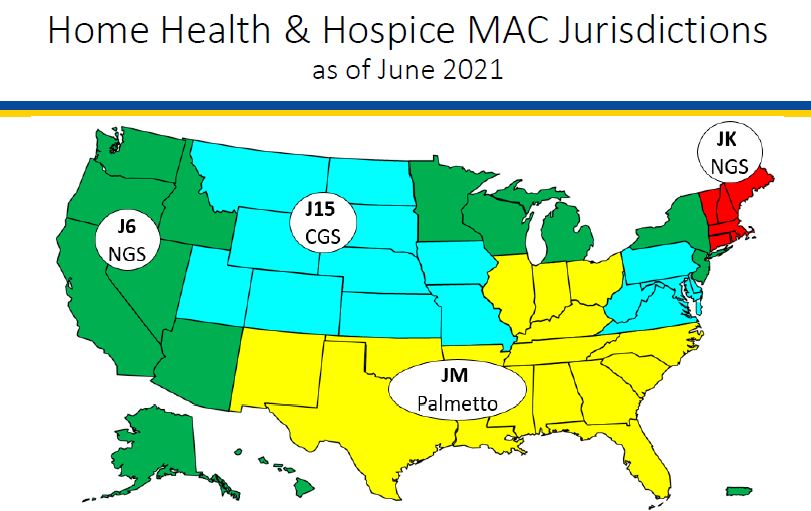

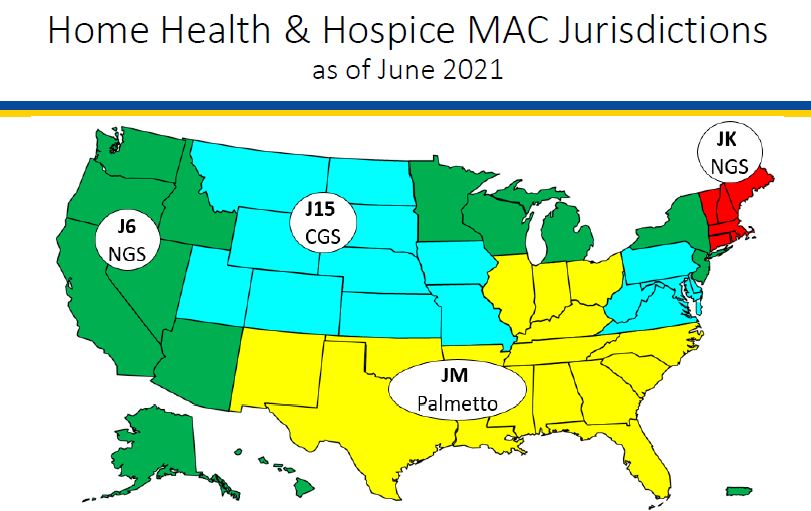

What geographic areas do each of the hospice and home health MACs cover?

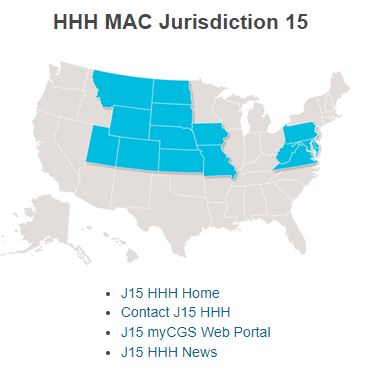

The following map shows the geographic regions that each of the hospice MACs is responsible for administering.

What activities do MACs perform?

MACS perform a number of activities including:

-

Provider Enrollment

-

Claims processing, payment, and payment notices

-

Provider customer service (but not beneficiary customer service)

-

Audit provider cost reports

-

Respond to provider inquiries

-

Audit payments and review medical records

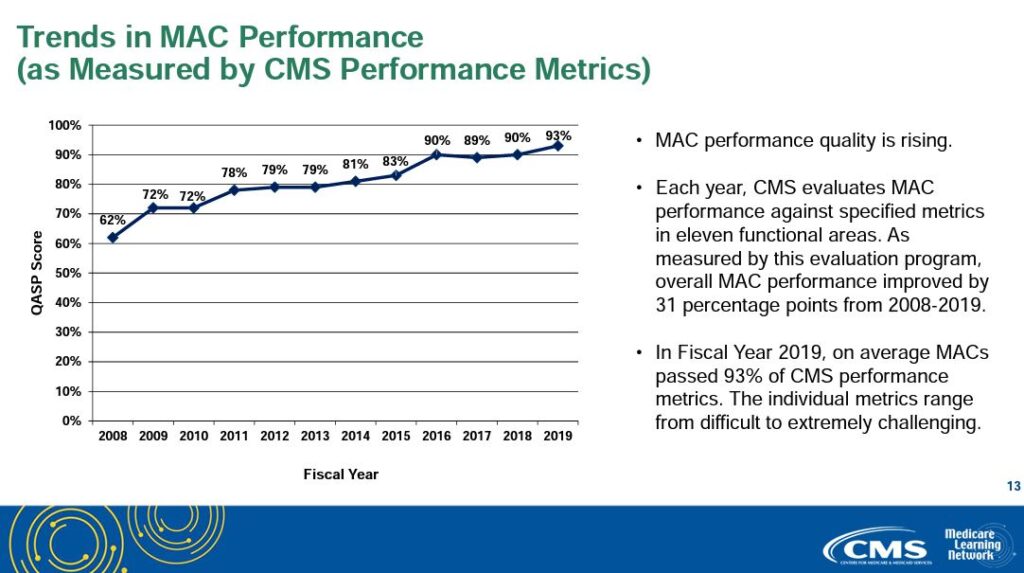

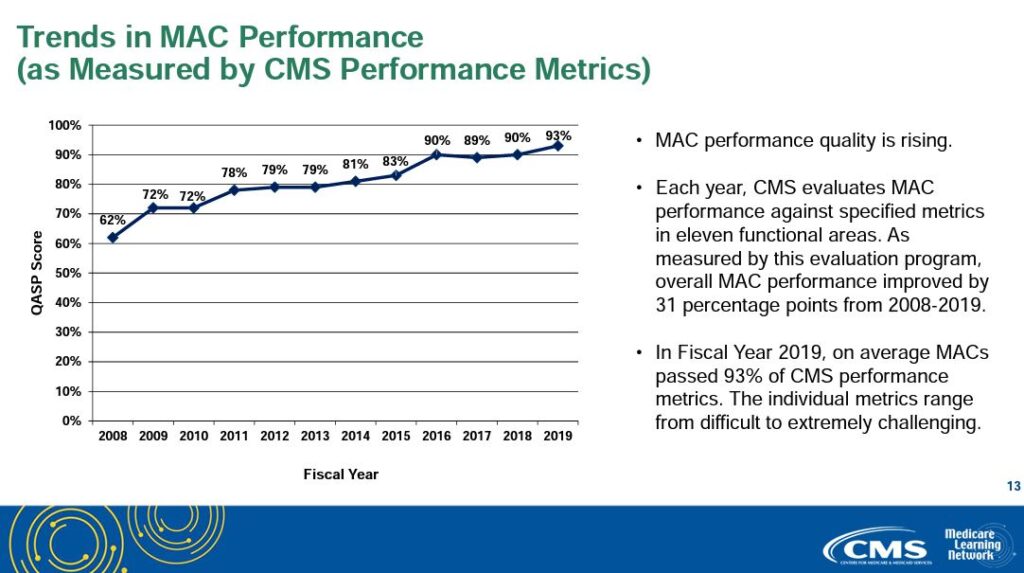

How are MACs measured and how well do they perform?

Each year, CMS evaluates MAC performance against specific metrics in eleven functional areas. MAC performance quality has been consistently improving since CMS began measuring MAC performance. Average MAC performance has increased from 62% to 93% since CMS began measuring MAC performance.

Print ‘n take hospice keys

- Seeking to contact your MAC? Here’s their contact information

hospiceKeys - CMS MAC contact

Download

- A map of MAC regional jurisdictions

hospiceKeys - CMS MAC

Download

Where can you find more information?

This PowerPoint from Medicare Learning Network provides more helpful information about MACs: MLN MAC PowerPoint