by editor | Mar 22, 2023 | Compliance and Regulatory - Directors, Metrics and KPIs, Rules and Regulations - Nurses, Rules and Regulations - Office Team

Patients are eligible for hospice if they have a terminal diagnosis and a prognosis of six or fewer months to live if their disease runs its natural course. A patient who lives longer than six months can still get hospice care if the medical director or other hospice physician recertifies that the patient is still terminally ill.

What is hospice patient length of stay?

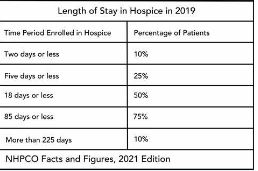

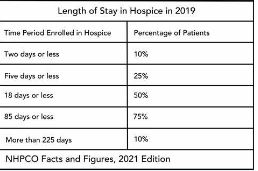

Hospice length of stay is an important metric that is monitored by both CMS and by hospice providers. Hospice length of stay measures the count of days that a patient receives hospice services, from the day that the patient is admitted into hospice until the day the patient is discharged (either alive or deceased). In 2018, 25% of Medicare beneficiaries received hospice care for seven days or less and 54% of Medicare beneficiaries received hospice care for 30 days or less.

Why should a hospice monitor patient length of stay?

Monitoring patient length of stay can aid in detecting cases of possible fraud or abuse – instances where ineligible patients continue to receive the hospice benefit. This metric also helps monitor whether the hospice benefit is being adequately utilized. Although patients are eligible for hospice when they have six months or less to live, most patients receive less than 30 days of hospice care.

Agency patient length of stay is also trended over time and is also compared against the value for patients in the same region, state, or nationwide. The metric may also be analyzed for patients in subpopulations – for example patients with the same disease, race, or ethnicity.

How is patient length of stay calculated?

Patient length of stay is calculated using all patients discharged by the hospice provider during the reporting period. For example, if the hospice would like to compute the length of stay for patients during the 4Q 2022, all patients who were discharged during 1Q 2023 would be included in the calculation. For each patient, the number of days from the date of patient admission until the date of patient discharge is counted; this represents the patient length of stay.

Patient length of stay = [patient discharge date]-[patient admission date]+1

What are common measures of length of stay?

Two common patient hospice length of stay measures are Average Length of Stay (ALOS) and Median Length of Stay (MLOS).

Average length of stay

Average length of stay is the arithmetic mean of the data collected. Specifically, if d is patient length of stay and N is the total number of patients then average length of stay (ALOS) is calculated as follows:

ALOS = ( d1 + d2 + d3 + …. + dn ) /N

Where di = patient length of stay for patient i

Median length of stay

Median length of stay is the middle number in the sequence of numbers. Specifically, compute the length of stay for all N patients. Then, order these N numbers in ascending order. The middle number is the median. If the number of patients is even then there is no middle number. Instead, the median is calculated by taking the average of the two numbers in the middle.

Comparing average and median length of stay

The average is sensitive to outliers in the data. That is, if there are a few patients with a very high length of stay while all other patients have a significantly lower length of stay, the average will be biased by these outliers and will give a misleading assessment of overall patient length of stay. Below, we give an example to provide greater intuition into the impact of outliers on average length of stay and the difference between mean and median length of stay.

Suppose a hospice agency discharged 35 patients during 4Q 2022. The patients’ lengths of stay are as follows:

We compute the average length of stay by summing each of the 35 patient’s length of stay (in the “Length of Stay” column) and dividing that total by 35 (the total count of patients).

Average length of stay (ALOS) = 38.5

We compute the median length of stay by sorting the patient’s length of stay in ascending order and identifying the central number. Since there is an odd number of patients, there will be a single central value. In this case, the central value is 20.

Median length of stay (MLOS) = 20

Average length of stay is almost double the median length of stay. What is leading to these significant differences between ALOS and MLOS? Observe the outliers in the data. There are two patients with length of stay that exceeds 200 days. There are two additional patients with length of stay exceeding 100 days. Since ALOS is sensitive to outliers, ALOS is being pulled to a higher value due to the presence of these outliers.

To provide additional insight, we have plotted a histogram of the length of stay values. A histogram shows the count of observations in the data that fall in each of the specified ranges.

The table on the left shows the count (frequency) of observations of patient length of stay in the data for each of the ranges: 0-10 days, 10-20 days, 20-30 days, 30-40 days, and greater than 40 days. There are 11 patients with length of stay between 0-10 days, 7 patients with length of stay between 10-20 days, 6 patients with length of stay between 20-30 days, 6 patients with length of stay between 30-40 days, and 4 patients with length of stay that exceeds 40 days.

Think about this histogram and now consider the MLOS and ALOS. Median length of stay is 20 days – it falls well in the middle of the data. Average length of stay, however, equals 38.5. It falls, essentially, in the final bar of this histogram and well beyond where the majority of the data lies. The provides a visual demonstration of the impact of outliers on ALOS.

Providers should monitor both ALOS and MLOS. Significant differences between these numbers would indicate the presence of outliers and should be investigated.

Print ‘n take hospice keys

- Understanding the difference between the average (mean) and the median

hospiceKeys-meanVsMedian

Where can you find out more?

by editor | Mar 22, 2023 | Human Resources, Interdisciplinary Team

How can your hospice organization find out what your employees are thinking? How do you know if your employees are satisfied? Dissatisfied? How do you know if employee satisfaction varies across different agencies in your organization? Do you have a systemic problem in one of your agencies? Is one of your regions better or worse than the others?

Using employee surveys to measure employee sentiment

Hospice organizations typically conduct employee surveys to try to dig into this information. Employee surveys are prepared by the corporate office and survey the entire organization – that is – all hospice agencies across the entire organization. The surveys are typically conducted no more frequently than once per year and involve significant planning and cost. A survey response rate of 70% is considered a good response rate.

Organization may also conduct more targeted “pulse surveys” – to gather the employee sentiment on a targeted issue. Pulse surveys are run more frequently, and a 50% response rate is considered a good response rate.

Using public data sources to measure employee sentiment

However, there is another valuable source of employee sentiment that is often overlooked by hospice organizations: both current and former employees post valuable company reviews on public employment websites. These reviews provide valuable and actionable insight that can be used to monitor employee sentiment, detect trends over time, identify differences between agencies or regions in the organization and a wealth of other useful information.

How can information from public websites be used?

How can a review from a public website be used to provide insight to a hospice agency? Let’s examine some reviews to see what insight can be gained.

Data points that we can gather from this review are the following:

- Rating: 5 star

- Employment status: current

- Date of review: March 10, 2023

- Type of employment: per diem

- Job role: Home recovery RN

- Location: Marshfield, WI

- General comments: supportive management

Here is another review:

Data points that we can gather from this review are the following:

- Rating: 5 star

- Employment status: former

- Date of review: April 10, 2017

- Type of employment: contractor

- Job role: data entry

- Location: Brentwood, TN

- General comments: excellent company to work for

Here is a third review:

Data points that we can gather from this review are the following:

- Rating: 3 star

- Employment status: former

- Date of review: August 1, 2021

- Type of employment: full time

- Job role: Patient care coordinator

- Location: Vestavia Hls, AL

- General comments: management does not respond to input

How can the data be stored so maximum value can be extracted?

A hospice agency should store the data in a database format – either in a database or in a spreadsheet – so that maximum value can be extracted. By storing the data in this manner, metrics of interest and can be created. Performance over time can be monitored. We provide an example below. Suppose the three reviews above are for three different locations for the same hospice organization – one for an agency located in Marshfield, WI, one for an agency located in Brentwood, TN, and one for an agency located in Vestavia Hls, AL. The data can be stored in a spreadsheet as follows:

Additional columns in the spreadsheet can be added to provide additional information. For example, categories of interest may be:

- classify the employee type by categories such as clinical, corporate, office team, etc.

- classify the city / state by regions in the organization.

As the number of rows in the spreadsheet grows patterns can be identified and valuable metrics can be created and monitored – in time and over time.

Where can you learn more?

by editor | Jan 29, 2023 | Human Resources, Interdisciplinary Team

Maslow’s hierarchy of needs is a theory that can be used to provide leaders and organizations with guidance on how to motivate employees. But what is this hierarchy and what is Maslow’s theory?

What is Maslow’s Hierarchy of Needs?

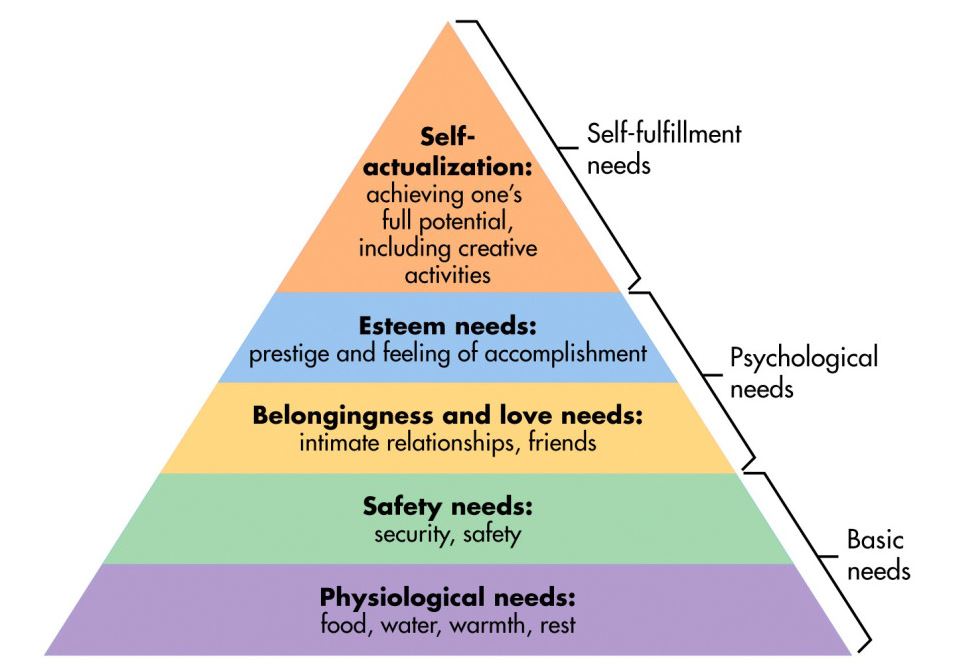

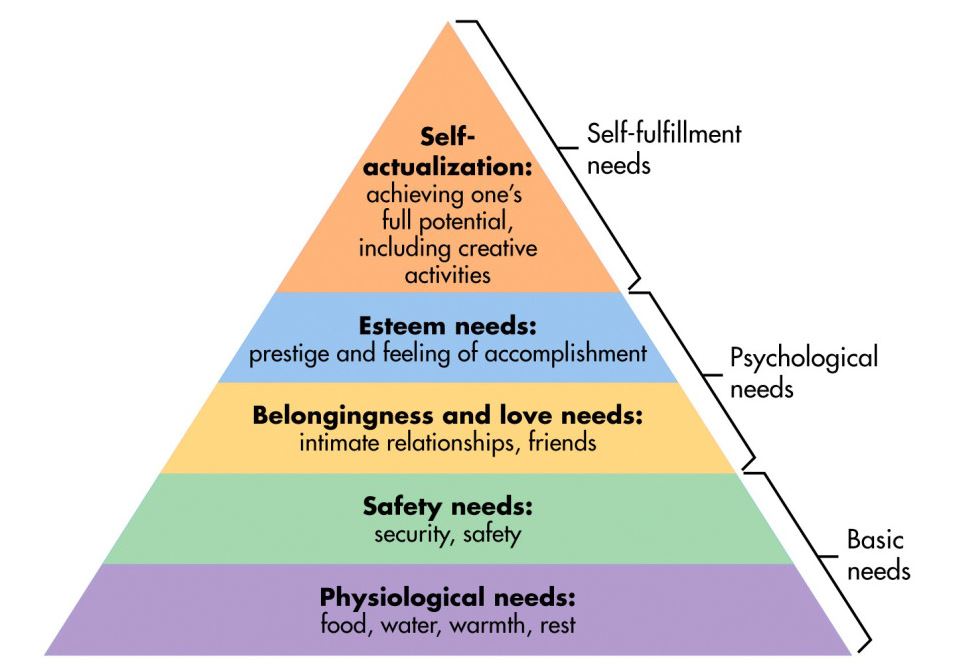

Maslow developed his theory on the Hierarchy of Needs in the 1940s. The hierarchy suggests that people are first motivated to fulfill basic needs before they move on to more advanced needs.

The theory states that there are five fundamental human needs that can be represented as a pyramid. Each of the five needs builds on the prior need. Individuals want to meet needs at a lower level before progressing to needs at a higher level.

The highest-level need in Maslow’s hierarchy is self-actualization, where an individual achieves self-fulfillment.

How does Maslow’s Hierarchy of Needs relate to leadership?

A good manager understands this hierarchy of needs and leads his team so that he is meeting each employee at the employee’s current level of need while simultaneously encouraging the employee to continue to move up the pyramid so that the employee eventually achieves self-actualization. In the workplace, self-actualization translates to an employee’s desire to maximize his potential at work.

What are the levels of the hierarchy?

In Maslow’s hierarchy, Level 5 is the lowest level and Level 1 is the highest level. An individual or employee will start at a lower level and move up levels as he tries to achieve the highest level in the hierarchy.

Level 5: Psychological needs – survival

This is a most basic need for survival. Employees at this level want to feel secure that they have a steady income.

Level 4: Safety and security

Managers and leaders need to make employees feel secure. Some managers do not realize this and think that employees will work harder if they are “kept on their toes.” But this strategy usually fails. Rather than working harder, employees become obsessed with job security.

- How can a leader make employees feel secure?

- Communication: Share the big picture with employees.

- Clear rules: Employees should know where they stand at all times

- Be supportive: Support employees if they are struggling or if they fail

- Be consistent: Be the same every day

- Be fair

Level 3: Belonging (social needs)

Employees enjoy a team environment and a social workplace.

- How can a leader create a social environment and a feeling of belonging?

- Conduct team meetings

- Create an area where people can gather, e.g., for coffee

- Encourage a feeling that people are a part of the team

- Organize social events outside of work

Level 2: Esteem/status

Employees want to be noticed, on occasion, and to stand out for their accomplishments and for what they do better than others. People like to feel important, occasionally.

- How can a leader meet this need of employees to feel important?

- Give employees regular recognition

- Spend time with employees

Level 1: Self actualization

Self-actualization is maximizing an self-fulfillment where an individual discovers his potential and uses his skills to the utmost. This is the highest level of Maslow’s hierarchy, where employees are maximizing their potential at work.

- How can a leader help employees maximize their potential?

- Give employees ownership of tasks or projects

- Empower employees

- Help employees find ways to advance in their careers

What defines a great organization?

Maslow believes that in a great organization, employees will be at the level of self-actualization. That is, all employees must achieve Level 1. For employees to achieve Level 1, leadership must support employees through all the lower levels of the hierarchy. The pyramid will crumble if employees are lacking the supporting levels.

Further, leadership must make it possible for employees to achieve self-actualization. Employees need to be trained, to acquire new skills, and to have an environment where they gain a sense of satisfaction. A good leader will learn his employees’ potential and create an environment where people are trusted, can flourish, and are given important tasks to complete. A good leader will create an environment where employees can achieve self-actualization.

Where can you find more information?

by editor | Jan 29, 2023 | Billing, Documentation - Nurses, Hospice 101 - Aides, Hospice 101 - Chaplain, Hospice 101 - Nurses, Hospice 101 - Office Team, Hospice 101 - Social Workers, Intake, Rules and Regulations - Nurses, Rules and Regulations - Office Team

What is the False Claims Act?

The False Claims Act (FCA) was established in 1863 during the Civil War to combat fraud and abuse perpetrated by suppliers of the federal government. At that time, the law was referred to as “Lincoln’s Law.”

The FCA has evolved significantly in recent years and is now one of the main tools used by the government to fight fraud. The FCA penalizes individuals or entities that submit fraudulent claims to the government, cause fraudulent claims to be submitted, or conspire to submit fraudulent claims.

One of the noteworthy provisions of the FCA is the qui tam provision, also known as the whistleblower provision. The qui tam provision allows private citizens, also referred to as “relators”, to report details of alleged fraud to the government. The whistleblower “stands in the shoes” of the government to prosecute the claim. This action benefits the government and the taxpayer as well as potentially the relator, who may receive a share of what is recovered.

How does the FCA relate to a hospice agency?

The False Claims Act allows hospice agency employees, patients, families of patients, or any individuals with alleged knowledge of fraud or abuse by the agency to report the behavior. Under the qui tam provision of the FCA, the relator may be entitled to a percentage of recovered funds.

What are different types of false claims?

A claim is a request for money made to the government. A false claim is money that is obtained from the government due to false or fraudulent claims. False claims include claims where the service

- Has not been provided

- Is already included as part of a different claim (i.e., double billing)

- Is not coded correctly

- Is not supported by the patient’s medical record

Claims may also be false and are covered under the FCA if they result from a referral made in violation of the Federal Anti-kickback statue (Stark Law).

The False Claims Act also includes payment from the government based upon false certification.

False claims include claims that the hospice agency should have known were false or fraudulent.

What is a claim that a hospice agency “should have known” is false?

The FCA expressly includes claims that a hospice agency “should have known” were false or fraudulent. “Should have known” means deliberate ignorance or reckless disregard of truth. As such, a hospice agency cannot avoid liability by simply ignoring inaccuracy in their claims. Examples of “should have known” include:

- Ignorance of billing rules, i.e., lack of knowledge of the rules

- Failure to act on consistent trends that are indicative of inaccurate billing

- Failure to act on inaccuracies or system errors identified by outside or internal auditing teams

- Failure to correct inaccurate billing (impacting either past or future claims)

A hospice agency must understand the rules and take proactive measures — such as conducting internal audits within the organization — to ensure compliance and accurate billing.

How can False Claims Act matters be initiated?

There are two ways that FCA matters can be initiated:

- Initiated by the government: When a FCA matter is initiated by the government, this type of matter typically starts with an audit or an investigation by the government. The government would determine that there is a false claim made to it and would initiate a matter, usually by a subpoena or civil investigative demand (CID). The government would issue the CID directly to the hospice agency. CID is a form of subpoena that requires the hospice agency to engage in one-sided discovery. That is, the hospice agency is required to produce documents demanded, respond to interrogatories, and provide sworn oral testimony. However, the hospice agency may not conduct any discovery.

- Qui tam matter: this type of matter is initiated by a whistleblower, also known as a “relator,” typically through the filing of a sealed lawsuit in a federal district court. The hospice agency does not know about the qui tam lawsuit since the lawsuit is initially served on the government. The case remains under seal while it is investigated by the government.

What is the qui tam process?

Qui tam actions are initially filed under seal. That is, only the US Attorney and some members of the Department of Justice (DOJ) have knowledge of and access to documents related to the case. The relator serves the complaint on the government together with a written disclosure of all material evidence.

The purpose of the sealed qui tam action is to allow the DOJ time to evaluate the relator’s allegations and for the DOJ to decide whether it would like to take over primary responsibility for prosecuting the case. If the DOJ decides to take over primary responsibility for the case, the DOJ is said to “intervene.”

The complaint remains under seal for 60 days during which time the DOJ investigates the relator’s allegations. This 60-day period can be (and typically is) extended. In fact, the government may spend months – or even years – investigating the case.

While the DOJ conducts its investigation, it may issue a Civil Investigative Demand (CID). This form of subpoena requires the defendant (the hospice agency) to engage in one-sided discovery where the hospice agency must produce documents, respond to interrogatories, and provide sworn oral testimony, as demanded. The CID is “one-sided discovery” because the hospice agency may not conduct any discovery.

If the government decides to intervene, the government is then responsible for litigating the case and files its own complaint instead of the complaint that was filed by the relator. The relator remains a party to the complaint.

If the government declines to intervene, the relator may proceed in her own name subject to the government’s right to dismiss the claim or to intervene at a later date.

Whether or not the government decides to intervene, the government remains the real party of interest. (As a reminder, the relator is only “standing in the shoes” of the government.) As such, the government must agree to any decisions on the case. The relator may not agree to dismiss or settle the case without the government’s approval.

What are the key phases in a False Claims Act investigation?

- Phase 1: FCA investigation is triggered. Triggers may include:

- Qui tam (whistleblower) lawsuit

- Call to OIG hotline

- Information identified during audit or claim review

- Complaints

- Data mining

- Phase 2: Formal investigation launches. Investigation may involve:

- Review of corporate filings

- Interview current or former employees

- Review financial records

- Electronic surveillance

- Physical surveillance of employees or of company premises

- DOJ civil investigative demand (CID), or the like

- Government search warrant or raid

- Phase 3: Litigation or resolution

Who are common whistleblowers?

Anyone can be a whistleblower and anyone may report alleged fraudulent activity to the government. The most common relators are:

- Business partners

- Current or former employees

- Competitors

- Patients

- Individuals who mine CMS data to identify anomalies/FCA claims

How can a hospice agency reduce the chance of qui tam lawsuits?

Any complaints or concerns that are raised – by employees, vendors, patients, or competitors, or any other individuals should be investigated and treated with concern as these have the potential to reveal compliance issues that need to be resolved by the hospice agency.

Employee complaints – whether from departing or active employees – are often an excellent source of information on potential compliance issues. A hospice agency should have a clearly established method – that is clearly and often communicated to employees – for employees to raise concerns. It should also have an organized process to diligently investigate and address any concerns raised by employees.

- Internal complaints:

- There must be an organized process – that is communicated regularly to employees – for employees to raise concerns

- All concerns must be investigated

- Have a plan to address any issues that are identified

- Take any necessary corrective actions

- Follow up with the individual who raised the complaint

- Provide training, as needed

- Departing employees

- Treat employees fairly as they leave

- Conduct exit interviews to identify any potential compliance concerns – investigate any issues that may be identified

- Potential releases (e.g., recovery from FCA claims)

Employees must feel that there is a process for raising concerns and that their concerns are heard. Employees should not fear retaliation for raising concerns. A hospice agency should be diligent and careful to respond to all employee complaints that are raised internally or to any complaints that are raised when employees leave the organization.

What are the financial benefits of avoiding FCA violations?

False claims act matters can be quite costly for a hospice organization. In addition to returning the payments associated with the false claims identified and incurring the costs associated with attorney fees to defend the matter, the hospice agency potentially faces the following significant costs:

- Treble damages: The FCA has a treble damages provision which provides that a hospice agency that is found to have violated the FCA statute may be liable to pay three times the amount of the actual false claim amount

- Penalty per claim: Under the FCA, a civil penalty may be assessed for each false claim that is submitted. The civil penalty dollar amount per claim has increased with inflation and currently may be as much as $23,000 per claim.

Where can you find more information?

by editor | Jan 29, 2023 | Compliance and Regulatory - Directors, Metrics and KPIs

Why is data valuable?

Like all other business decisions, a hospice marketing plan must be data driven. More progressive hospice agencies have increasingly begun to understand the value of many types of data in supporting business decisions. This includes internal data such as patient EMR data, financial data including general ledger revenue and expense data (at various levels of aggregation), and quality data. It also includes external data such as publicly available claims data, cost report data, and referral data.

This article published in June 2021 discusses how hospice agencies are using data analysis as a tool to gain an edge over competitors when engaging with potential referral sources. The discussion focuses on use of data analysis to identify which physicians represent referral sources that are more likely to produce (higher quality) referrals. This 2016 NHPCO article discusses the use of hospice metrics as a marketing tool. For example, a hospice agency can share statistics on reduction in hospital admissions for its patients in hospice compared to hospital admissions prior to hospice admission. Other metrics on cost of care or patient satisfaction are of interest, depending upon the referral source.

What data is valuable for designing a marketing strategy?

A hospice should gather data so that it can develop a complete picture of the customers that it serves. It should analyze its patients – including referral sources and patient attributes such as patient diagnosis, length of stay, and patient demographics. Referral sources can be analyzed at different levels of aggregations such as geographic location, facility type, physician type, and physician name. Analysis of hospice patients should be compared to analysis of data for the entire market (in the relevant geographic region). This can help a hospice agency identify where it may have strengths or weaknesses and contribute to its marketing strategy.

Analyze the data: gain input from multiple sources

When analyzing the output of the data analysis, the hospice agency should solicit input from multiple sources in the organization. Combining different perspectives on the data such as input from the executive, marketing, and clinical teams will provide a more holistic view and a more accurate assessment of the current marketing performance and how the go-forward marketing strategy should be designed.

How can the data be analyzed?

The simplest method for analyzing the data is to use Microsoft Excel. Excel is widely used in most organizations, so gaining access to this software should not be difficult. With relatively simple commands, one can analyze data and create charts to visualize the results of data analysis. Another benefit of using Excel for data analysis is that a lot of educational material is available on the Web to answer any questions that you may have about using Excel – in case there are data analysis functions that you want to learn more about.

What other information may be relevant to developing a strategy?

Patient data and claim data are historical data that are important inputs to a developing a marketing strategy. A hospice agency should also analyze forward-looking data as well as more general information such as:

- What are hospice market trends in the geographic region?

- How competitive is the marketplace and are there expectations for change in competition in the near term?

- How well is the role of hospice understood by communities in the geographic region?

- Is the use of hospice accepted by communities in the geographic region?

- Is hospice understood by the medical community in the geographic region?

- What are the demographics of your geographic region and are they expected to change in the near term?

Combining analysis of historical and forward-looking data and soliciting input from team members with different perspectives such as operational, clinical, and marketing will help a hospice agency develop an effective marketing plan.

Where can you find out more?

Using hospice metrics for marketing