Who are Hospice Agency Payers?

A payer is the company of government agency that pays the provider, i.e., the hospice agency, for the medical service that is administered to the patient.

For most hospice agencies, Medicare is the primary payer for hospice services. See, for example, this study published by Bazell et al., 2019, https://bit.ly/3RS805r. The characteristics of payment vary by payer. As such, an agency should understand the distribution of its revenues and receivables across different payers. In addition to understanding the breakdown of total receivables, the agency should look at distribution of receivables by payer – further broken down by aging bucket.

Expected time to be paid on a claim varies by payer. For example, payment for a Medicare claim is usually received within 14 days of the date the claim is submitted. A claim submitted to a commercial payer will take longer and further varies by the commercial payer. It is important to monitor time until payment is received for each payer. Delay in payment is an opportunity to quickly identify if there is a billing error that needs to be corrected. Or, there may be an opportunity to improve the billing and collection process that will result in an increase in speed of collections.

It is also useful to compare your agency’s metrics to industry standards. Metrics that are worse than industry standards could point to areas of the collections process that could benefit from process improvement.

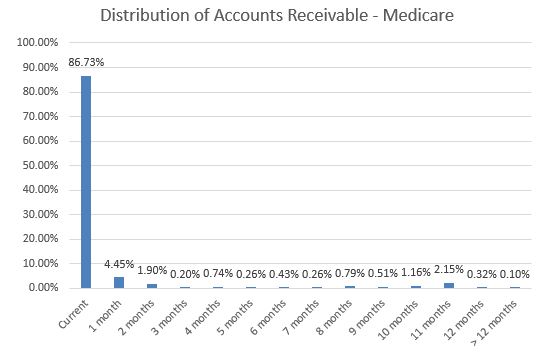

Aging Accounts Receivables for Medicare and Commercial Payers

The following graph shows aging accounts receivable for the Medicare payer. As we see from the graph, over 90% of the receivables are less than two months old.

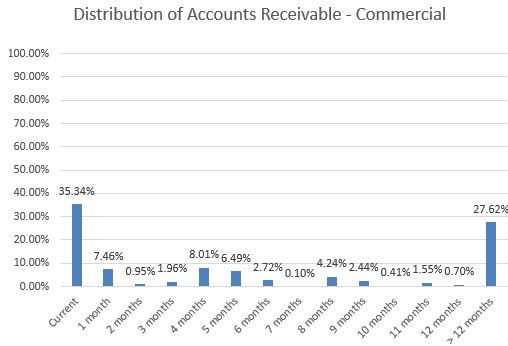

In contrast, here we can see the distribution of aging accounts receivable for commercial payers for the same hospice agency.

In contrast to the Medicare accounts receivables, here only 43% of the receivables are less than two months old. 25% of the receivables are between four and eight months old. More significantly, more than 25% of the outstanding receivables are more than 12 months old – a sign that there may be a high number of receivables that may have to be written off.

What is the key takeaway?

Different payers have different payment patters and different rules for timely submission of claims. Hospice agencies need to have a good understanding of the distribution of their claims and the distribution of their outstanding accounts receivable to reduce the likelihood of write-offs.

0 Comments