What is a UPIC?

Unified Program Integrity Contractors (UPICs) are contracted by CMS to conduct detailed medical review, data analysis, and audits of healthcare providers to investigate possibilities of Medicare or Medicaid fraud, waste, and abuse.

While the primary purpose of a RAC or MAC audit is to review payments, the primary purpose of a UPIC audit is to investigate when there is suspicion of fraud – especially fraudulent billing practices. A UPIC audit can lead to federal Medicare fraud charges or criminal prosecution. As such, UPIC audits are more serious than other audits.

What is a UPIC’s scope of responsibility?

Prior to UPICs, Zone Program Integrity Contractors (ZPICs) had been responsible for performing fraud, waste, and abuse detection and prevention activities for CMS. In 2016, CMS began to transition to the UPIC program. This transition took a number of years, with ZPIC contracts rolling over to the UPIC program as ZPIC contracts expired. The ZPIC program has now been phased out and replaced with UPICs. UPICs were formed as part of the Comprehensive Medicaid Integrity Plan (CMIP) with the intention of consolidating under a single federal contractor work performed by numerous Medicare and Medicaid program integrity contractors. UPICs combine all federally funded integrity reviews into a single audit and place payments to all federally funded payers under a higher level of scrutiny.

Consolidating responsibility provides UPICs with access to more data and information about healthcare claims, billing, and payments to hospice agencies. By increasing the level of information and data to which UPICs have access, UPICs have improved ability to identify billing anomalies and fraud.

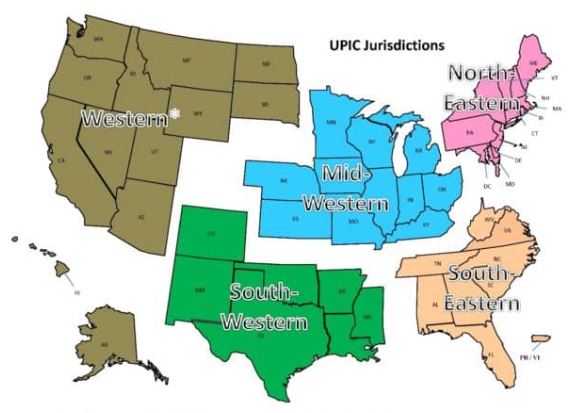

With respect to regional responsibility, the United States has been split into different geographic jurisdictions: Western, Mid-Western, North-Eastern, South-Eastern, and South-Western. Each UPIC is responsible for handling federal-level audits for both Medicare and Medicaid in one of the different geographic jurisdictions.

How is a hospice agency targeted for a UPIC audit?

UPIC audits are usually triggered by statistical analysis of hospice claims and billing data that identifies anomalies in in a hospice agency’s billing. Factors that often lead to a hospice being targeted for a UPIC audit include:

- Billing trends that are inconsistent with industry trends

- Long inpatient stay

- Referral from law enforcement or a federal agency. (For example, a hospice agency may be referred to a UPIC if at the conclusion of a MAC investigation for improper billing, the findings cannot be classified as billing errors or misunderstandings.)

- Complaints to the OIG

- Inaccurate Medicare billing

- Greater frequency of high end services as compared with local or national averages and patterns

What activities may be involved in a UPIC auditor’s investigation?

UPIC audits are focused reviews. A UPIC will request medical records and conduct interviews to determine whether fraud has occurred.. The UPIC’s audit process typically consists of a detailed review of the hospice’s records to confirm all Medicare billings. A UPIC auditor’s activities may be varied and may extend well beyond a review of medical records and documentation including activities such as:

- On site visit

- Interview hospice patients and/or hospice agency employees

- Review clinical, financial, and time production records

- Perform data analysis

- Look for prior agency violations

How does a UPIC audit progress?

A UPIC audit will typically begin with a letter requesting submission of documents – typically within 30 days but sometimes within 15 days. Most UPICs will agree to an extension of time for document submission.

A hospice agency should carefully review the nature of the request. Is the UPIC only requesting administrative and claims related medical records or is the UPIC also requesting documentation relating to the hospice agency’s business practices?

If the UPIC requests information about the hospice agency’s business practices or business relationships – such as its referral sources – this may indicate that the UPIC received information that the hospice agency is engaged in questionable business practices. If the UPIC identifies improper practices, the hospice agency will be referred to the Office of the Inspector General (OIG) or Department of Justice (DOJ).

If the UPIC only reviews claims and the associated medical or billing records, then there are typically two cases:

- Case 1 – The UPIC requests ten or fewer post-payment claims: the UPIC is likely conducting a “Probe Sample”. The purpose of a probe sample is to check if there are problems with the hospice agency’s billing practices, medical necessity, or documentation. This means that the data analyst identified a potentially problematic pattern following the data analysis. The investigator was notified of this pattern and a sample of claims is requested that match the identified pattern. If no significant problems are identified in the initial sample of claims, the UPIC typically issues an “Education Letter”. If numerous problems are found, the UPIC usually expands its audit and issues a request for a larger sample of 30 or more claims.

- The auditor will extrapolate based upon the findings of the 30 or more claims. Extrapolation allows the auditor to identify the error rate in the sample, and then extrapolate the error rate over the entire universe of six years of claims. (Six years is the maximum look back period for claims review.) For example, if the auditor collects a sample of 50 claims and errors are identified in 10 claims, then the error rate is 10/50=20%. It is then assumed that the accuracy of the billing identified in the sample is indicative of the entire universe. Consequently, the error rate of 20% identified in the sample is applied to the entire universe. Even if the hospice agency changed processes, billing software, or billing staff during the duration of time period of the universe, the sample error rate is still applied to the universe. As such, the impact of extrapolation is often quite significant.

- Case 2 – The UPIC requests 30 or more claims: the UPIC likely selected these claims as part of a “Statistically Relevant Sample” and will extrapolate the error rate that it finds to the entire universe of claims.

UPICs also conduct unannounced office visits to hospice agencies. If an office visit occurs, the UPIC will arrive at the office site with written request for patient medical records. They will also interview patients and hospice agency workers.

What may be the outcome of a UPIC audit?

A UPIC audit may result in payment suspension if there are findings that indicate the existence of overpayment, incorrect billing, or fraud.

When a hospice agency is faced with payment suspension, it may follow the standard Medicare appeals process. Legal counsel may be helpful in guiding a hospice agency regarding rights as applied to recoupment and claims withholding.

Payment suspension sometimes occurs without prior notice to the hospice agency. If the agency receives prior notice, it has 15 days to rebut. The UPIC must respond within 15 days of receiving the rebuttal. CMS then determines if the suspension should be removed. In most cases, the suspension remains in place.

Initial payment suspension can last up to 180 days with two unappealable 180 day extension periods.

A hospice may continue to provide services and submit claims while payments are suspended. During the suspension period, payments are not made to the hospice. Instead, payments are made to an escrow account that is managed by the UPIC.

If overpayments are identified, they are taken from the escrow account. The balance remaining in the escrow account is returned to the hospice agency once the audit is completed.

If the UPIC identifies any fraudulent behavior, the activity is referred to the Department of Justice (DOJ) or to the Office of Inspector General (OIG).

What if a hospice agency disagrees with UPIC findings?

A hospice agency may appeal overpayments identified by the UPIC through the Medicare administrative appeals process.

How can a hospice agency prevent UPIC audits?

By increasing their compliance efforts and activities, hospice agencies can prevent UPICs and decrease the chance of a negative outcome from a UPIC audit. More specifically,

- CMS requires that every hospice agency have a compliance team. In addition, compliance reporting duties must be defined.

- A hospice’s compliance plan must be kept current and should include

- How to update coverage guidelines from CMS

- Billing protocols

- Staff hiring and training on protocols

- Documentation guidelines

- HIPAA information and training

- Protocols for cross checking Medicare and Medicaid claim data

- Hospice compliance teams should conduct periodic and random internal audits of patient records, billing documentation, and required signatures. Compliance teams should look out for persistent errors and indications such as is additional biller training is required – either for the team or for a specific biller? Or, is there a new regulation that the team is not familiar with? Is there a physician who is consistently late with signatures? A clinician whose documentation does not look complete or timely? Charts should be audited randomly but on an ongoing basis and indications of the need for self-disclosure should be followed up on. Self-disclosure results in overpayment, but it typically removes a hospice agency from being a target for UPIC audits since it is an indicator that the hospice conducts internal self-audits and returns overpayments, as necessary.

- Hospice agencies can hire third party auditors to conduct chart and coding audits. These third-party auditors can suggest improvements to billing processes or hospice operations to improve compliance with regulations.

- Track all payer document requests and reimbursement denials; these may help identify billing problems before they are identified by an auditor.

Where can you find out more?

- Husch Blackwell – hospice audits and UPICS put pressure on hospices and how hospices can respond

- CMS auditor contractor directory – interactive map

- UPIC – FAQ

- Overview of UPICs – Nexsen Pruet

0 Comments